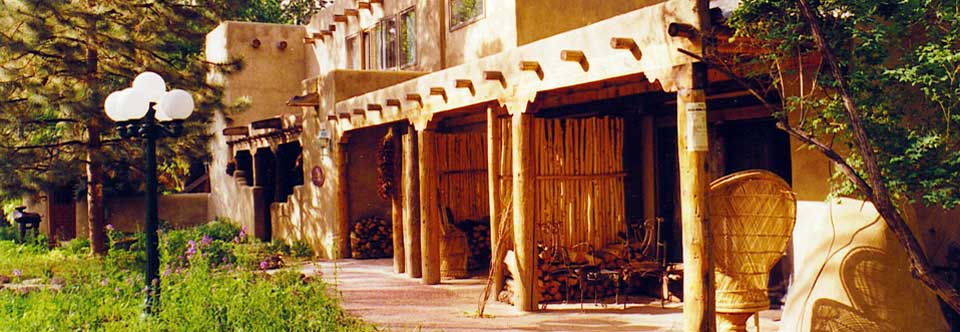

"Touchstone Inn is THE Cool place to stay in Taos! 7400 Ft. Elevation"

LOCATION, LOCATION, LOCATION - A Short Walk to Kit Carson Park Music Venues

Rooms and Rates

LEGAL NOTICE GIVEN: There is a $23 million dollar Lien on this property against BANK OF NEW YORK MELLON, now BNY. If you are considering purchasing this property, DON’T! The people you are dealing with are criminals and all involved will be prosecuted to the fullest extent of the law. If you are a property owner in New Mexico, be afraid, be outraged! This could happen to you as it has to others with targeted properties. BNY has a record of targeting desirable properties, covertly placing a 1st-Lien HELOC on a Second Mortgage of any Lender, lay in wait, in our case 20 years and I received ZERO dollars from their ‘loan’ then, as a third and fourth generation Plaintiff, proceed to Evict these properties by presenting their fraudulent documents and lieing to a District Court Judge, making the court and sheriff’s department complicit in their crimes, then disappearing by assigning their second mortgage HELOC to another entity a few weeks after eviction without a trace of ever being involved in the theft and grand larceny; however we have the proof and the evidence of their transgressions.

Touchstone is now closed due to circumstances beyond our control. After their hostile takeover and 6 month decimation of the Properties at Touchstone, leaving nothing intact, criminals headed by Rose Ramirez and Associates, Tiffany and Bosco, Bank of New York Mellon, US Bank, S&S Financial, and predecessors Bank of America and JP Morgan Chase, and [Reported individuals’ names have been removed here], committing fraud on the court, lieing to and making complicit District Court Judges on record in contempt of higher court orders providing a Writ of Assistance to Taos County Sheriff’s Department, the mendacious criminals are now offering it for sale with the ironic challenge to, “Revive this property back to its original glory,” after they themselves have destroyed it, such an uncalled for tragedy. Plaintiffs’ agent certified that she served me; she did not, yet another liar. She was involved in the physical eviction of nine people with no notice, she denied access to recover documents and belongings, now she is the Realtor offering the property for sale considerably below value, a Conflict of Interest. Touchstone was a viable business on the day of the abrupt Wrongful Eviction at the start of our season, May 1, 2023, with a totally booked Memorial Day weekend, a totally booked June concert in the park, and bookings into September all paid, in-hand deposits had to be refunded, over $28,000.

Three Documents dictate the status of this claim in MY favor, NOT in favor of Plaintiffs or their Predecessors and Successors: On June 29, 2017, New Mexico Court of Appeals ruled in my favor that US Bank does not have Standing to Foreclose, reversing District Court Judge McElroy’s decision. On January 7, 2010, the Order and Final Decree was handed down by Federal Judge Robert H. Jacobvitz Closing Case 11-05-10321, Order Granting US Trustee’s Motion to Dismiss or Convert to Chapter 7 after five years, calling the case fully administered and substantially consummated, READ THE FOOTNOTES. Plaintiffs failed to appear at the last hearing and were given two weeks to appeal the decision; they failed to do so. August 14, 2008, Stipulated Order by Federal Judge McFeeley, 11-05-10321, explains that secured creditors could foreclose as of May 19, 2006, with Confirmation of the Plan, reverting parties to their status prior to filing of Stay on January 19, 2005, six years from that date is January 19, 2011; however, the Federal Order and Final Decree in my favor takes precedent, SOL January 7, 2010; all secured creditors are treated the same, including BNY’s fraudulently concealed claim on a Countrywide Second Mortgage placed October 14, 2003. from which I received ZERO Dollars. Even with the knowledge that Federal Chapter 11 court had litigated and judged this case, District Court Judge Shannon based his decision to issue a Writ of Assistance on fraudulent information, altered note indorsement and fabricated documents filed by the Plaintiffs. Judge Shannon who had knowledge of the Chapter 11 Decree from his time in Magistrate Court was in contempt of Higher Court Orders when he chose to issue a Writ for Assistance with a license to steal, after he wrongfully ruled that I failed to appear at a hearing on August 10, 2022, for his online court at which I most certainly did appear along with my attorney, Timothy Padilla.

I drove all the way from Taos to Albuquerque to be at that Zoom hearing, and I most certainly was at that hearing. At the last minute, the hearing was moved from 9:30 AM to 9:00 AM and switched from Zoom to Google Talk; nonetheless, we were in attendance waiting to be let into the chat room as we listened to banter in Spanish and English for about 15 minutes being carried on in the courtroom, then the Clerk came on to say, “Mr. Padilla, you are excused.” We were in attendance at that hearing and the Clerk would not let us into the chat room. Mr. Padilla was sent to hospital that day in an ambulance, and he withdrew from my case on May 9, 2023, after the wrongful eviction on May 1, 2023, due to health issues. I then filed approximately 20 emergency documents Pro Se in the courts by May 15, 2023, to quash the unlawful Writ, all of which were ignored. At the next hearing, in September, 2023, I went to the Courthouse in Taos to appear in person, and was made to sit in the hallway outside the courtroom on my cell phone as instructed by the Court Clerk, saying we were not allowed inside the Courtroom, COVID was a non issue at that time. The Clerk refused to file exhibits that I twice presented in person.

I purchased the property outright in 1983 with no mortgage. The black and white spreadsheet [provided upon request] shows revenues from 1983 that have nothing to do with mortgages and show an equity in the property of around 2.2 million dollars sans any mortgages. The property was burned by arsonists, November 22, 1992, and was rebuilt with insurance monies by December 1993. There was no mortgage until 1996 when funds were needed to finish remodel of 110A. This whole fiasco has been an unconscionable travesty of willful theft and grand larceny. This has been a failure of the judicial system not knowing what the right hand is doing while the left hand is allowing irreparable harm come to innocent people, destroying a valuable icon of Taos.

Weddings at Touchstone

This is a Predatory Lending case involving 14 flipped mortgages within 2 years’ time that was settled over five years of litigation in Federal Chapter 11 Court with a Final Decree and Order upholding the US Trustee’s Motion to Dismiss or convert to Chapter 7 and close the case as fully administered and substantially consummated. The Plaintiffs failed to appear at the final hearing and were given two weeks to oppose the order; they failed to do so. All of the secured creditors with first and second mortgages and HELOCs were subject to this order, read the footnotes. The two original Lenders were Countrywide-America’s Wholesale Lender on 110A, January 1, 2002, culminating with refinance on October 14, 2003, and Bank of America on 110B, February 11, 2002, culminating in refinance, last mortgage on 110A May 17, 2004, backdated to May 14, negating my 3-day right of rescission and adding $20,000 to principle with no net benefit to me; the $20,000 went to the Broker S&S Financial who was paid in spite of Lack of Specific Performance on 110B. Neither of these original lenders filed for Foreclosure. Bank of America assigned that mortgage on 110B to JP Morgan Chase, allegedly January 4, 2005, but Chase did not mention the Assignment in their Complaint for Foreclosure, January 12, 2005, siting Page 680, paragraph 10 of Complaint as proof of ownership of the note, excluding that page from my Service document, which I discovered years later is simply a Subordination Agreement between National City Mortgage and Bank of America; there is no mention of JP Morgan Chase. JP Morgan Chase had no Standing to Foreclose. Nor was the Assignment of Mortgage filed of record until January 21, 2005, the same day I was Served with the Summons and Complaint for Foreclosure, violating Chapter 11 code because I had filed Chapter 11 Stay for reorganization on January 19, 2005. I never received nor knew of that Assignment of Mortgage until 2015, and I paid the wrong lender over $38,000, $31,000 in adequate protection payments, no payments were ever made to JP Morgan Chase. Monthly payments on all 4 mortgages were over $10,000, plus there was no Escrow, so I also paid property tax and insurance on elevated mortgage amounts, and continued to do so until August 2013 when my payments were usurped by Bank of America which fabricated two fake mortgage payments on each property in July and August of 2013, and used those fraudulent documents as Reasonable Cause to reopen JP Morgan Foreclosure case that had been closed, LOP. Bank of America had State Farm to refund the insurance payments to me. I paid the property taxes through 2009 up to a planned administrative transfer to 501c3, but those were also usurped by Plaintiff, all part the of Record Proper litigated in District Court and ignored by Judge Backus. There were 2 Bridge Loans by private investors in Chapter 11 that take precedent over all other loans. These funds were used for adequate protection payments demanded by the banks committing Fraud on the Court by Omission because they covertly hired a BPO and knew that they were adequately protected by the value of the property, almost $4,000,000. The Chapter 11 case lasted 5 years from January 2005 to January 2010, and private funds were used for completion of the construction at 110B Mabel Dodge Lane which was lacking the whole front of the building, and was NOT finished with bank funds. District Court erred in reopening the case in 2013, using the fake documents created by Bank of America as Reasonable Cause for third generation Plaintiffs to reinstate their case as the Statute of Limitations had expired; this was Fraud on the Court. Bank of America Purchased Countrywide in July of 2008, during Chapter 11. Bank of America committed Fraud, fabricating two fake mortgages on each 110A and 110B in 2013, which were then passed on to successors US Bank and Bank of New York Mellon who filed this evidence as Holder in Due Course, committing Fraud on the Court, lieing to the Judge Kennelly as to the date of last mortgage payment being in 2014 when the actual last payment was in August 2004, and had already been called into default as seen in JP Morgan Chase’s Complaint for Foreclosure, paragraph 5 of the Complaint, and part of the Record Proper, January 12, 2005, and in Countrywide’s Motion for Lift of Stay in Chapter 11, both of which were litigated and dealt with in Federal Chapter 11 Court. Federal Judge McFeeley’s Stipulated Order explained that secured creditors could foreclose as of May 19, 2006, with the Confirmation of the Plan; they failed to do so. With Confirmation of the Plan, parties’ status is reverted to that prior to placement of Stay, January 19, 2005, setting the trigger date for Statute of Limitations expiration as January 19, 2011. I received a total of $539,425 over all mortgages of all properties; the cost to finance 110A and 110B was $886,000 of which the Broker received $197K + $45K=$242K, and principle on 110B was raised $409,000 plus $172,000 subtracted from the construction loan out of blue sky = $577,000 in principle fluff with no net benefit to me, earning interest for 20 years. The 110A property added another $45,000 second mortgage on the HUD converted to a HELOC secretly converted to a 1st lien + $20,000 principle fluff on 110A bank principle =$642,000 total overall blue sky added to bank principle with no net benefit to me earning interest for 20 years. I have invested over 2.2 million of my own money, and 40 years of my life in the property sans any mortgage. This business loss is devastating to the Town of Taos, the State of New Mexico, and to the citizens of the world as well as to myself and my family! A valuable historical asset to the community and to the world has been deliberately and pointlessly extinguished. A magnificent tapestry woven of events and memories by participants from all over the world has been knowingly and wantonly destroyed. I want my property back, I want my contents and business loss insurance to be paid by State Farm Insurance, which they are obligated to do by NM law, because the eviction was based on fraud. I want my paintings, drawings and writings returned, which are covered by Article I, Section 8 of the US Constitution; I want restitution and damages from BNY for the irreparable harm they have caused me, my family and the world at large for 22 years of physical, mental and emotional suffering and loss of opportunity, reputation, theft, Grand Larceny, and RICO for being one victim in their Racket BNY has perpetrated on the American people, amassing $176 Trillion in assets.

About Us

A cold call in February Y2K by S&S Financial, Albuquerque, offering to ‘help’ me build my residential teaching studio resulted in division of my property into 3 parcels, and 14 flipped mortgages between January 2, 2002, and May 17, 2004 with approximately $640,000 blue sky fraud added to principle; therefore, I filed Chapter 11 on January 19, 2005, where the case was litigated over 5 years, including the same Countrywide Second Mortgage from which I received zero dollars. BNY, an undisclosed party of interest funded a $45K Countrywide Second Mortgage which was converted to a HELOC, then a 1st-Lien HELOC, fraudulently concealed on October 14, 2003

On October 4, 2007, during Federal Chapter 11 case, Bank of America with connections to S&S Financial out of Downer’s Grove, Illinois, covertly engaged a Broker’ s Price Opinion, a BPO, which resulted in almost 4M $ estimated value accessed overall of my property. The Plaintiffs knew they were adequately protected but withheld this information from Federal Court committing Fraud by Omission, and insisted that adequate protection payments be made even though the Plan Contract to which they had agreed specifically stated that no such payments would be required because all funds were earmarked for reorganization and to finish construction on 110B. Bank monies did NOT complete construction which was missing the whole front of the building as seen in the June 6, 2004 survey of 110B showing poured footings labeled as ‘wall’. This survey does not include 110C and shows the true boundaries of 110B Mabel Dodge Lane, despite the mortgage document having the wrong description as seen in the J P Morgan Complaint for Foreclosure January 12, 2005, number 3: “If there is a conflict between the legal description and the real property address, the legal shall control”; clearly exhibits their doubts and confusion as to the correct description of 110B. A document has been filed with the Taos County Clerk to correct the erroneously adjoinment of 110C Mabel Dodge Lane to 110B Mabel Dodge Lane: TAOS COUNTY CONFIRMATORY INSTRUMENT OF CORRECTION. This survey was ordered by S&S Financial June 6, 2004, three weeks after the last closing on 110B. The wrongful Eviction Writ was for 110A and 110B, NOT 110C. yet Rose Ramirez and Associates continued to carry on with unlawfully plundering 110C Mabel Dodge Lane, even when she had that information, from the letter sent June 28, 2023, by certified return receipt mail, not exparte` communication as the documents were sent to all parties. The People’s Bank debt for 110C was ostensibly paid 4 times POC, Paid Outside of Closing; the actual payment was made by myself February 15, 2002, with cash out, free and clear as my homestead using a $100K CD held as collateral by People’s Bank for a business line of credit, LOC which was converted to a mortgage at the request of the Lender. The $100,000 was my money to which the Line of Credit was added to the debt, not to exceed $65,000, so of the $157,000, it was an agreement and understanding with my banker that instead of subtracting the debt amount to keep track, I made monthly payments at 10% to the bank on the excess above my $100K CD as a business line of credit, and at the time of pay off, I owed $57,000 plus a monthly loan payment, I did not owe $157,000; the $100,000 was my money, CD as collateral. Paid outside closing was added to both streams of debt,on 110A, $157K + $20K they made me pay out of pocket which included the last monthly payment and was added to 110A Mortgage principle with Countrywide and the same $172K amount was added to the Bank of America mortgage principle debt, and same payout was a subtraction from the $500K construction loan of which I received $309,000 from the $319,000 withheld for construction after again paying the same $172,000 POC, so $344,000 plus $172K= $516K + the $45K fraudulently concealed by BNY + the $20K added to last Mortgage on 110B; all of this fraudulent excess was added to the total bank principle out of blue sky and collected interest for 20 years. The same $172K blue sky was subtracted from the $500K construction loan, reserving $319K for disbursement, but I never received the last $10,000 of the Construction loan. I created the Follow the Money Chart over the years trying to discover what happened to my final $10,000 which revealed 2 kickbacks to the Broker, S&S Financial. There is also the matter of conspiracy to commit fraud by fraudulent concealment of $126K Second on 110B that was purchased by Chase, who was not otherwise a party of interest at that time, 6 days after closing with S&S Financial who was the Lender under the guise of National City Mortgage, then withheld the $126K Second from closing with its paired First mortgage to be paid off on 110B. S&S Financial under the guise of National City Mortgage, then lied about the whereabouts of the Second mortgage which was scheduled to be paid off; commitment for title insurance was in place for $195K, from which I was to receive $69K to finish construction, did not happen, I was denied a better deal which would have benefited me and would allow finish of construction on 110B. On 110A another fraudulently concealed second mortgage occurred, just discovered June 9, 2024, committed by Bank of New York Mellon as funder of the $45,000 added to principle on 110A as a Second Mortgage, covertly converted to a 1st-Lien HELOC by BNY, and fraudulently concealed from which I received ZERO dollars, illegally and covertly converted to a 1st lien OVER Countrywide’s $630K 1st Lien on 110A which was received by S&S Financial including their $562 commission with a check written in the amount of $45,562 and I received ZERO from that line of credit, October 14, 2003. This $45,000 listed on the HUD as a Second Mortgage and included in the Chapter 11 Final Decree as called into default along with the First Mortgage by Countrywide, I am now being dunned $79,000 with the Resolution Trust as owned by Bank of New York Melon on 110A, who was assigned the mortgage on 110B from Bank of America in September 2015, now conveniently, as of June 15, 2023, claimed by Merrill Lynch, $81K, allowing BNY to DISAPPEAR as if they had nothing to do with the Eviction. Bank of America purchased Countrywide in July of 2008; the same $45,000 HELOC then was assigned to Merrill Lynch in July of 2023, and now is dunned to me as $81,000, all of which was settled in 2005 thru 2010 Chapter 11 case and should have never been brought forth in District Court as the Statute of Limitations has run, as well as the ruling of the Final Decree takes precedent, 15 years ago, 22 years since BNY targeted my property with their premeditated formula for stealing desirable properties, and now two years in exile after their Wrongful eviction.