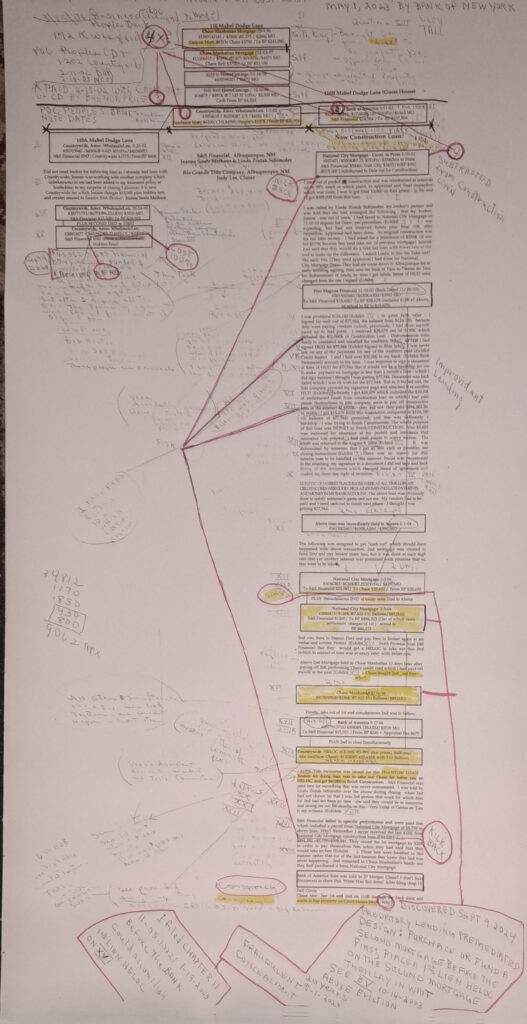

A COLD CALL IN EARLY 2000 WITH THE OFFER FROM S&S FINANCIAL TO HELP ME BUILD A RESIDENTIAL TEACHING STUDIO, RESULTED IN DIVIDING THE PROPERTY INTO 3 PARCELS AND 14 FLIPPED MORTGAGES, 13 PLACED BY S&S FINANCIAL BETWEEN JANUARY 2, 2002 AND MAY 17, 2004, LED TO FILING CHAPTER 11, JANUARY 19, 2005, BANK OF AMERICA, COUNTRYWIDE AND JP MORGAN CHASE WERE INCLUDED ALONG WITH BANK OF NEW YORK WHO HAD UNDISCLOSED AND FRAUDULENTLY CONCEALED A 1ST-LIEN HELOC AGAINST A COUNTRYWIDE SECOND MORTGAGE, DOCUMENTS INCLUDED BELOW. ON NOVEMBER 22, 1992 MY HOME WAS BURNED BY ARSONISTS AND A TWO STORY SHELL WAS REBUILT WITH INSURANCE MONIES OPENING DECEMBER 23, 1993, WITH 2 RENTAL ROOMS. PEOPLE’S BANK HELPED ME WITH A BUSINESS HELOC TO FINISH REBUILDING; PEOPLE’S BANK WAS PAID IN FULL BY ME WITH CASH OUT OF $100K CD HELD AS COLLATERAL ON FEBRUARY 15, 2002. THIS HELOC AGREEMENT WAS CHANGED TO A MORTGAGE ON DEMAND BY LENDER AND WAS THEN ADDED POC TWICE TO EACH OF 110A AND 110B MORTGAGE STREAMS AND WAS THEN SUBTRACTED FROM THE $500K CONSTRUCTION LOAN SO ADDED BLUE SKY DEBT ADDED TO PRINCIPLES OF $561 FROM WHICH I RECEIVED ZERO. PLUS MORE THEFT AND FEES COLLECTING INTEREST FOR 20 YEARS.

THE ‘FOLLOW THE MONEY CHART’ BELOW OUTLINES INFORMATION ON THE 14 FLIPPED MORTGAGES AND WAS INITIATED TO DISCOVER WHERE THE LAST $10,000 OF MY CONSTRUCTION LOAN WENT, IN PINK SEE KICKBACKS. THIS CHART HAS NOT BEEN UPDATED AS TO NEW DISCOVERIES IN SEPTEMBER 2024.

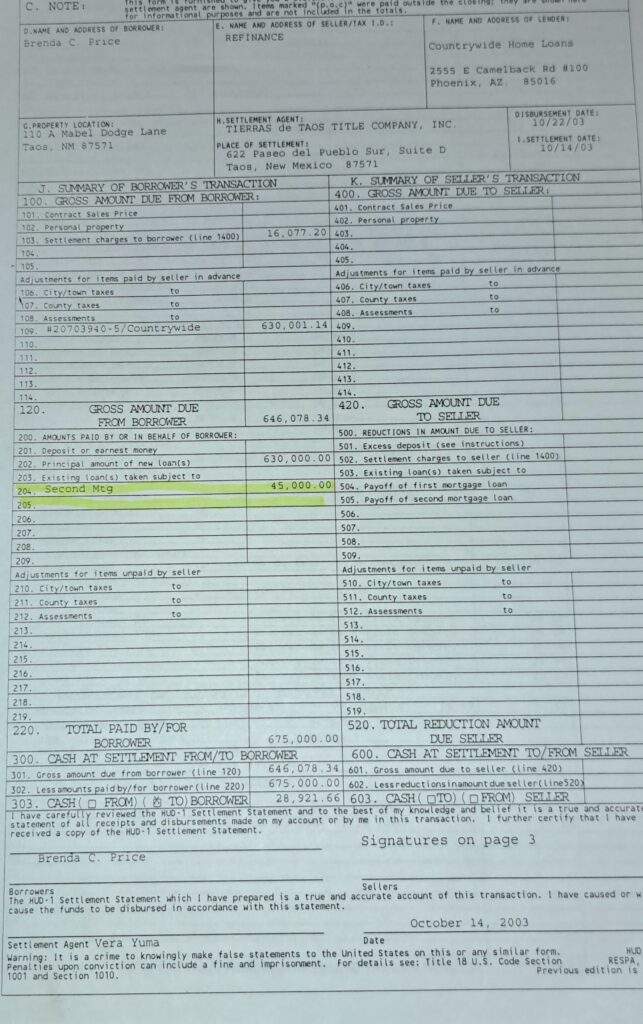

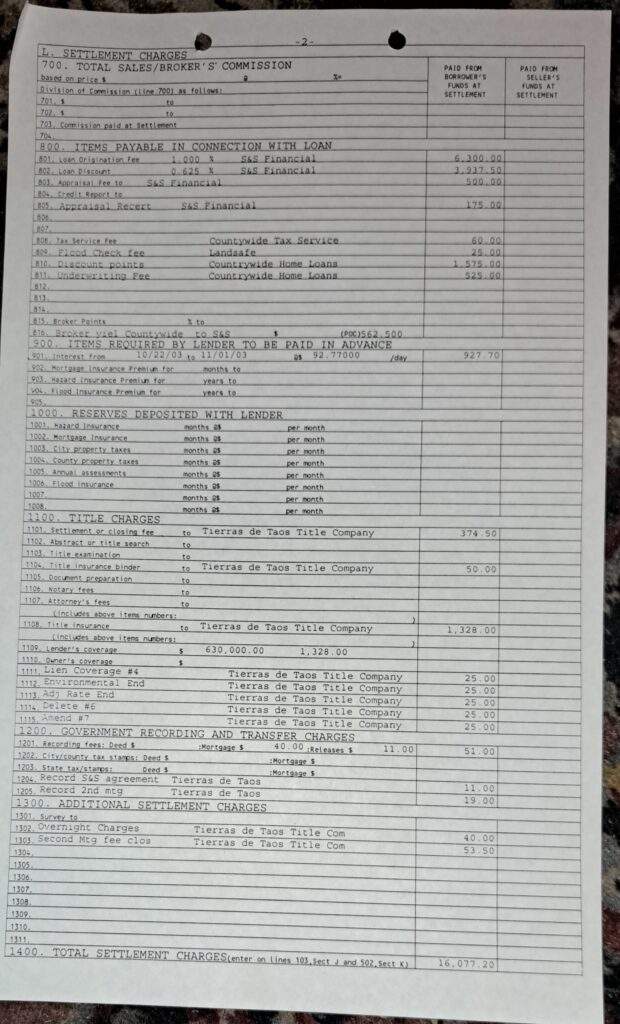

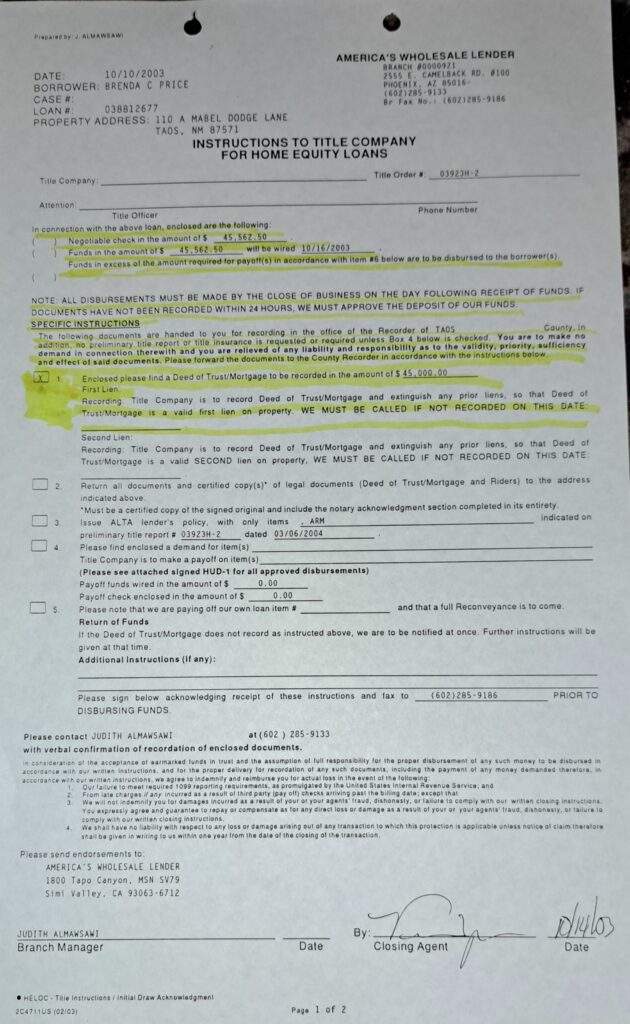

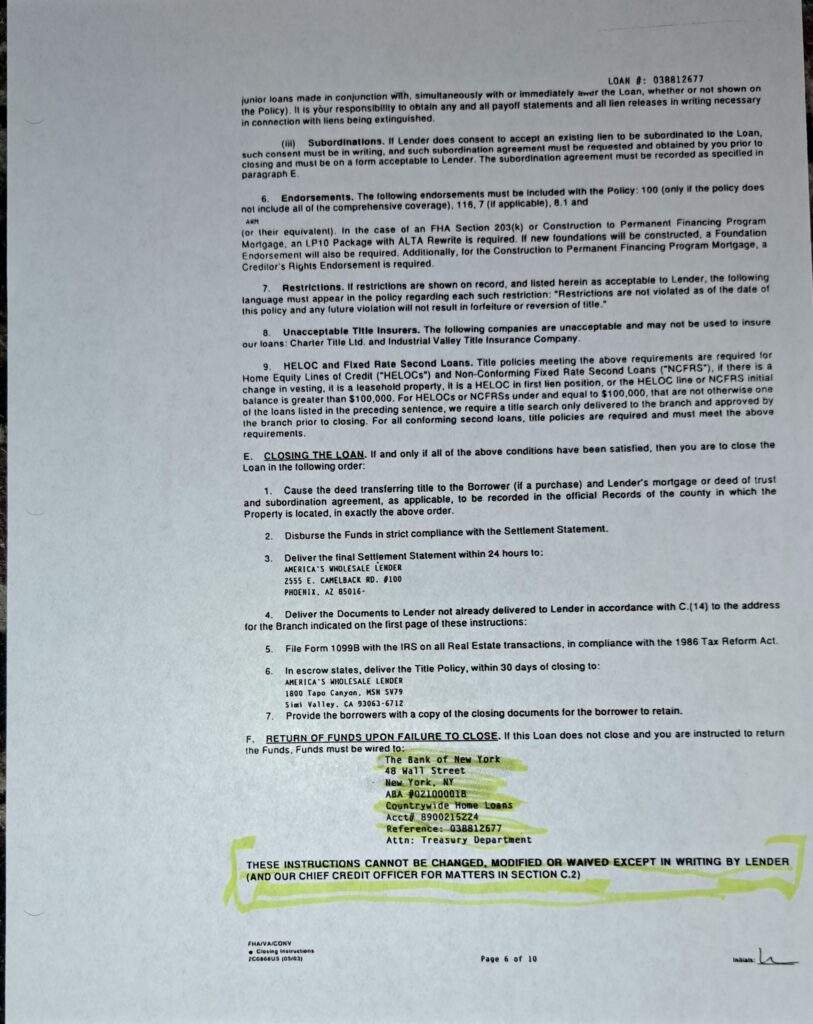

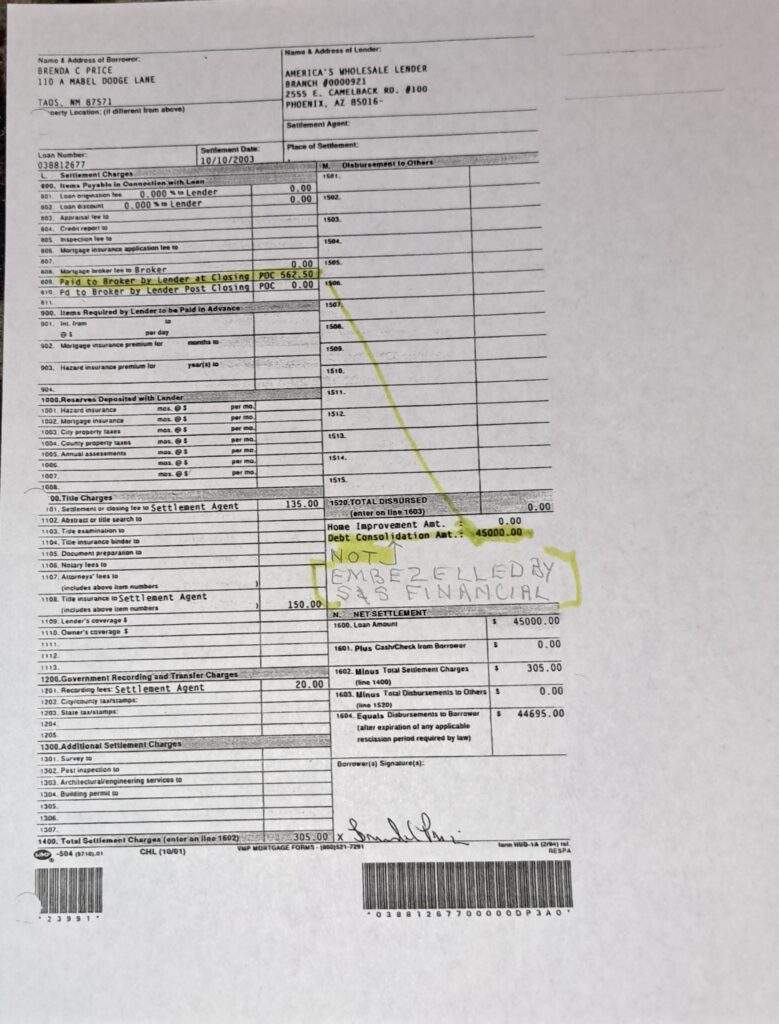

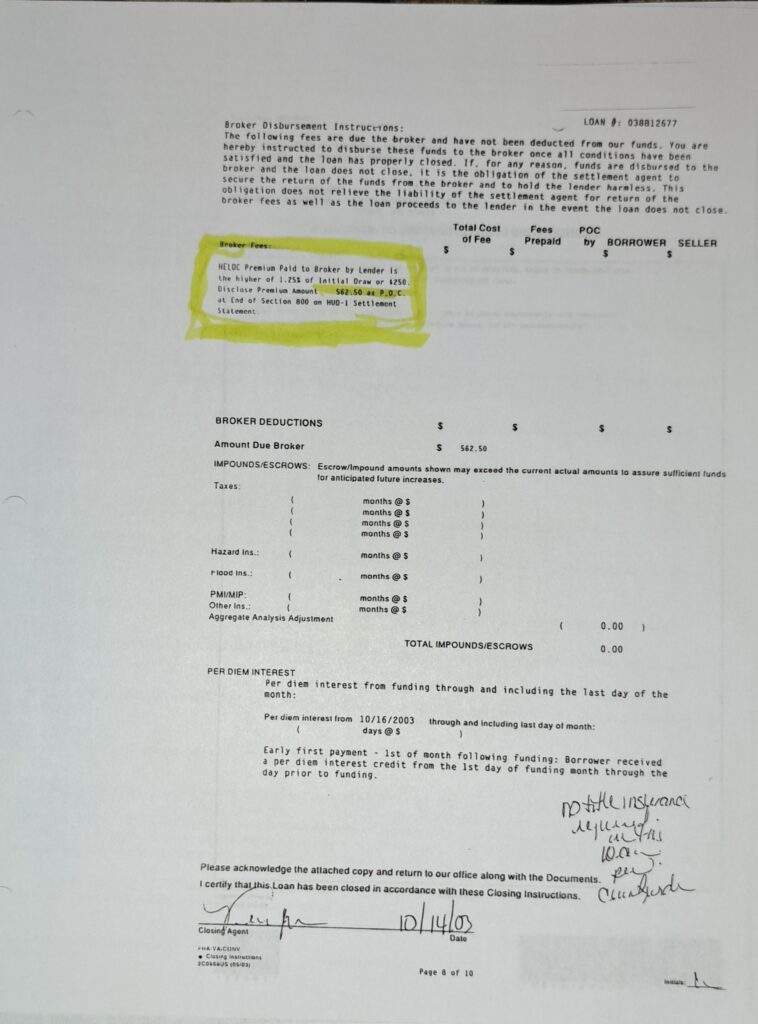

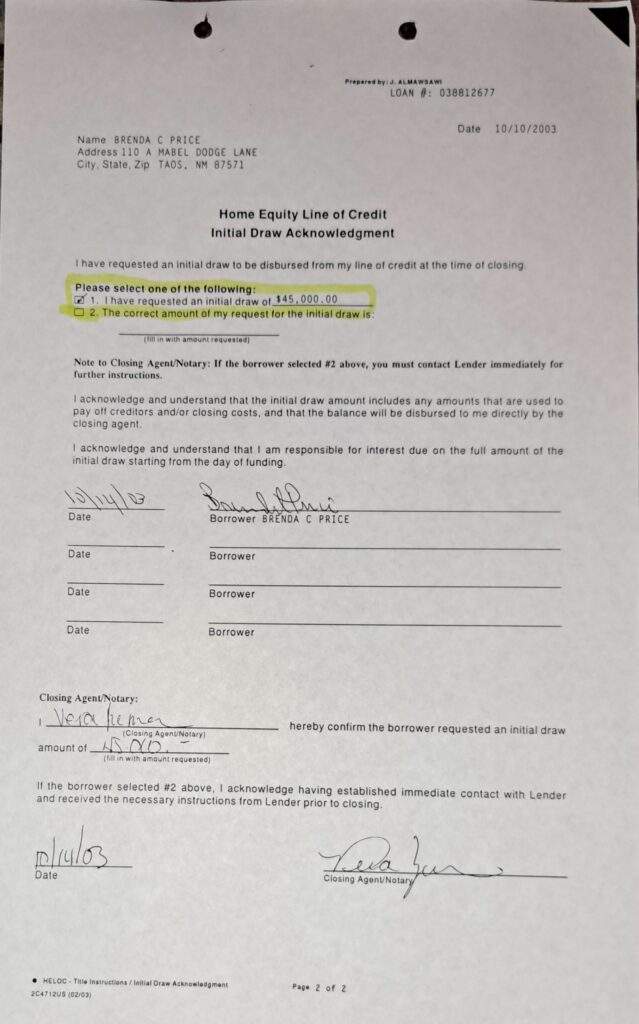

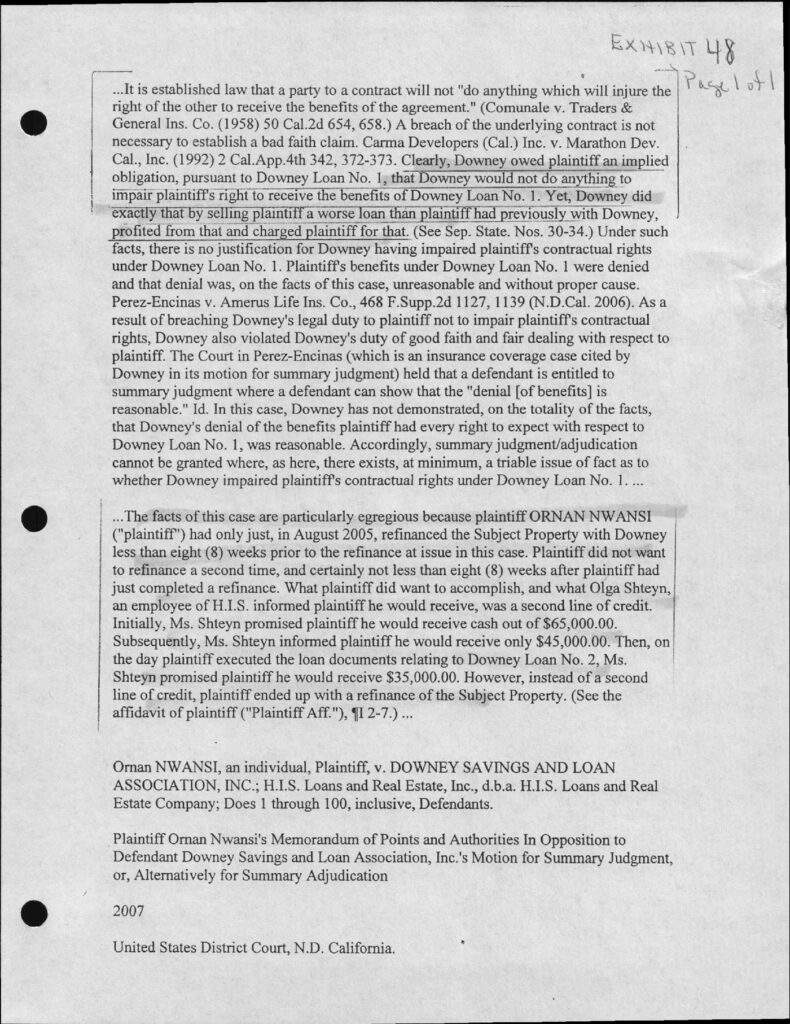

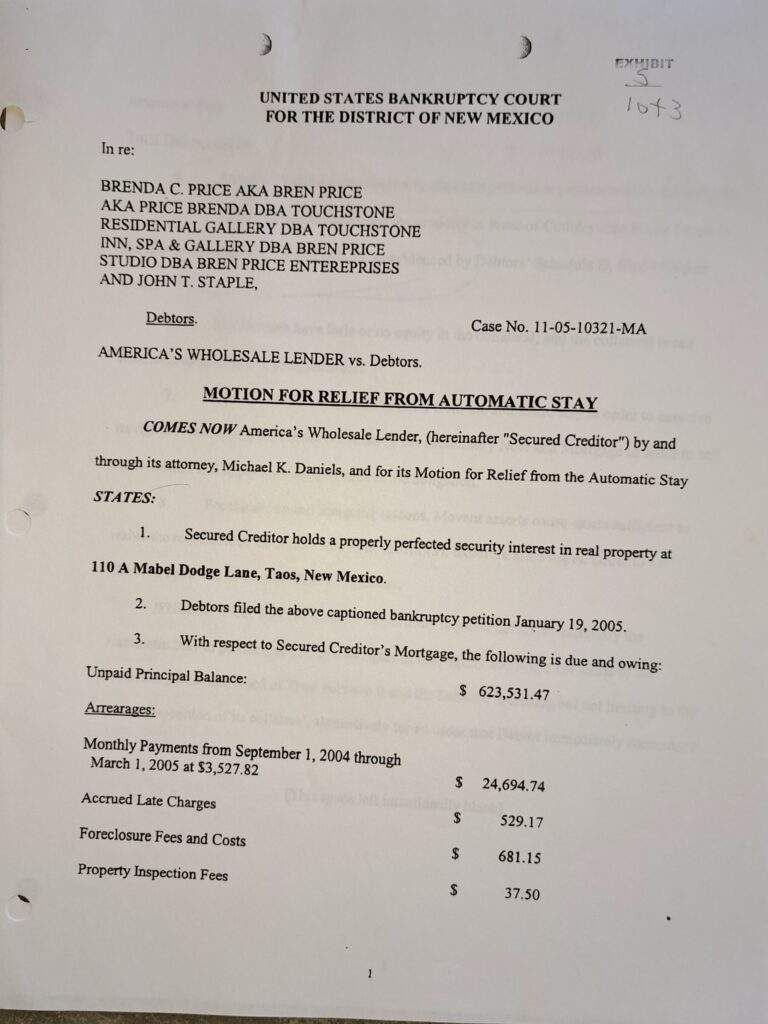

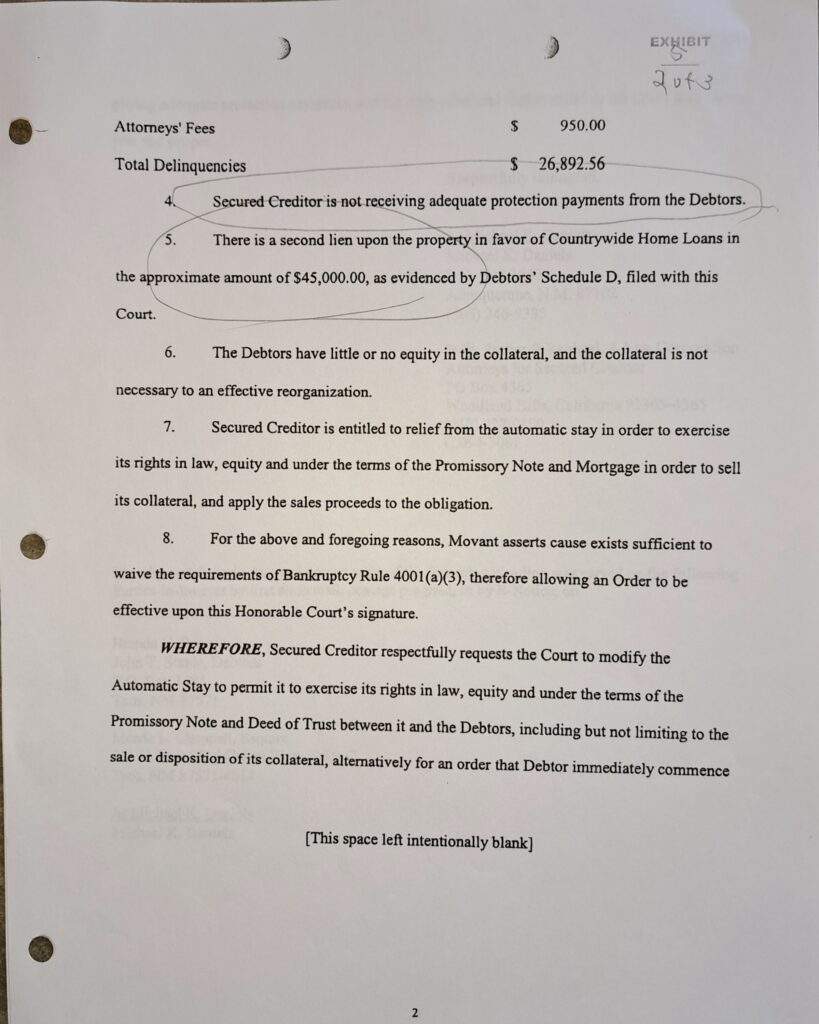

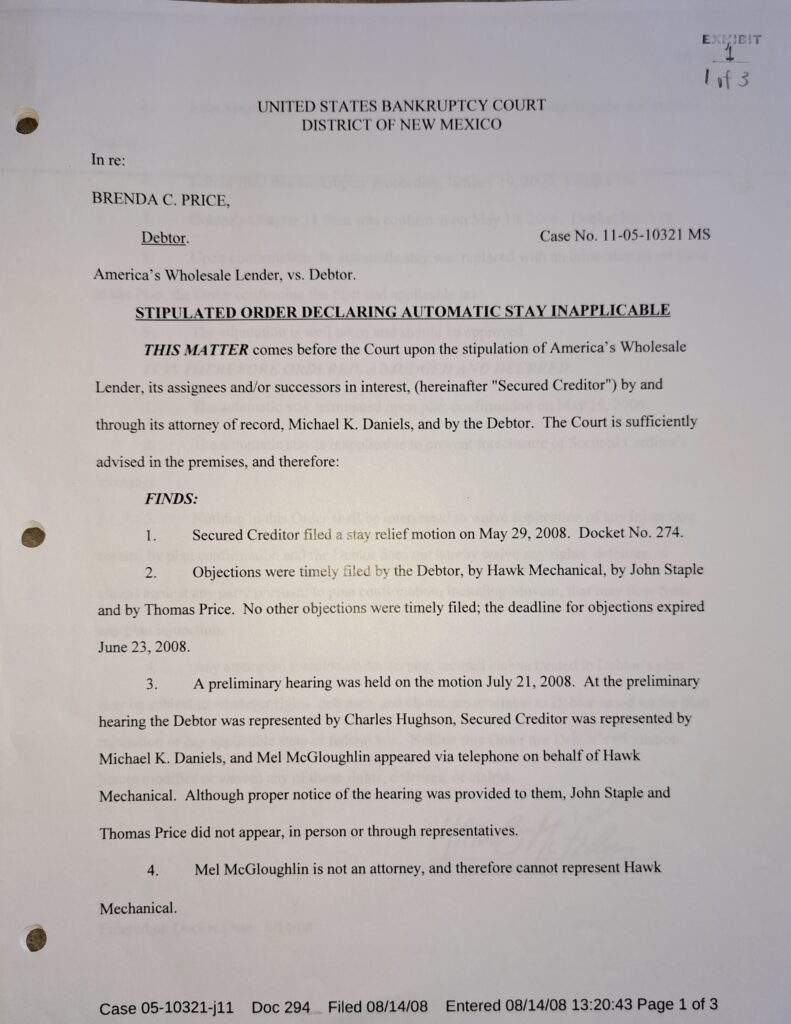

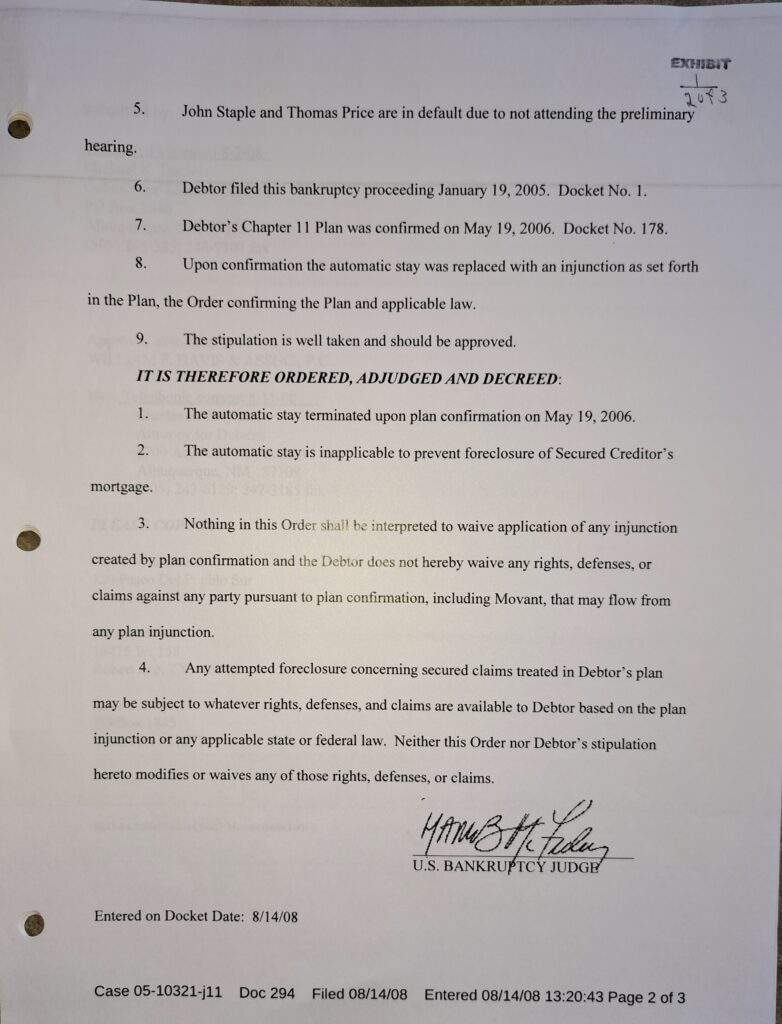

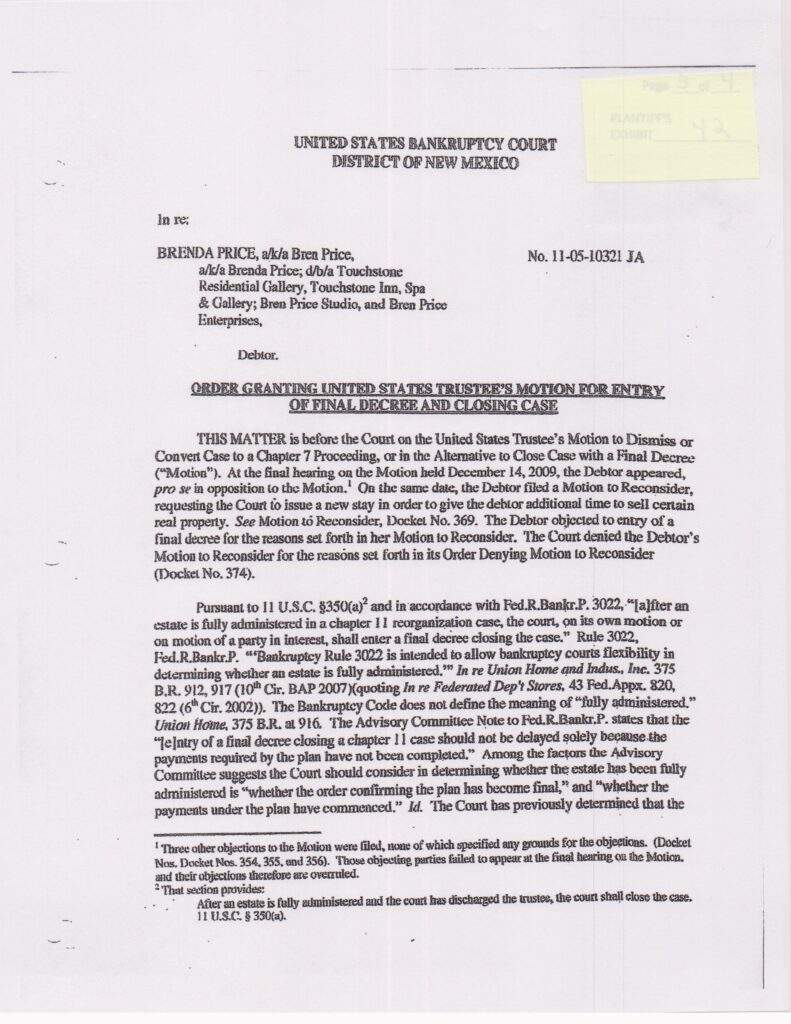

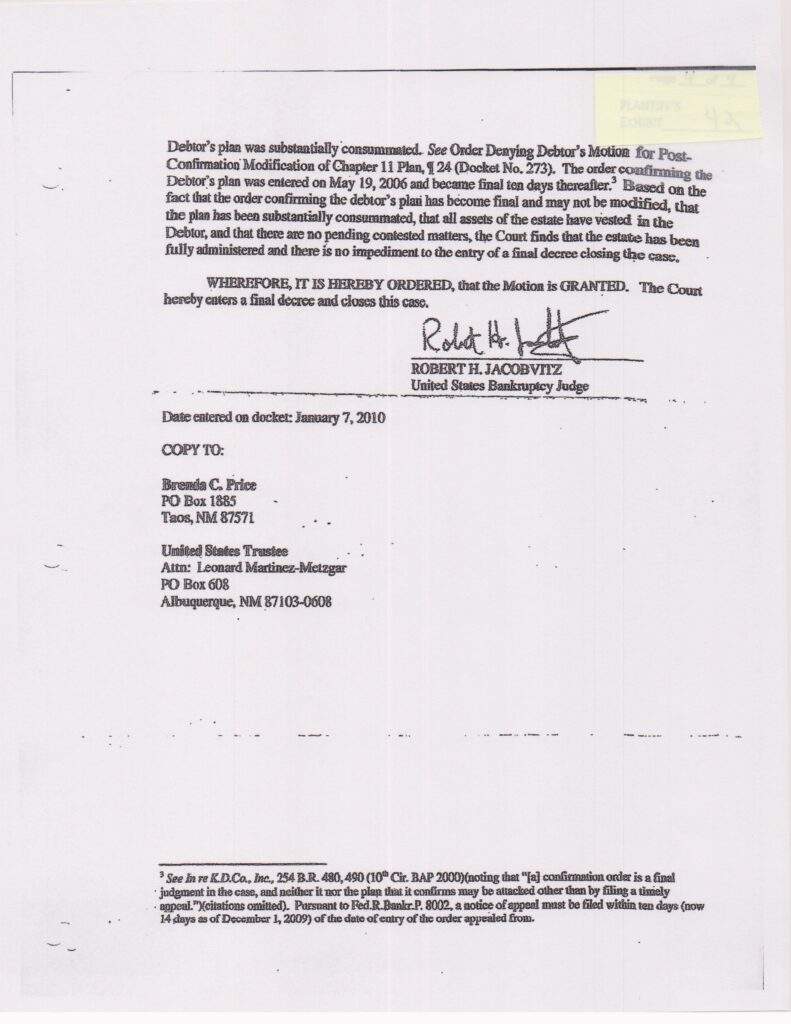

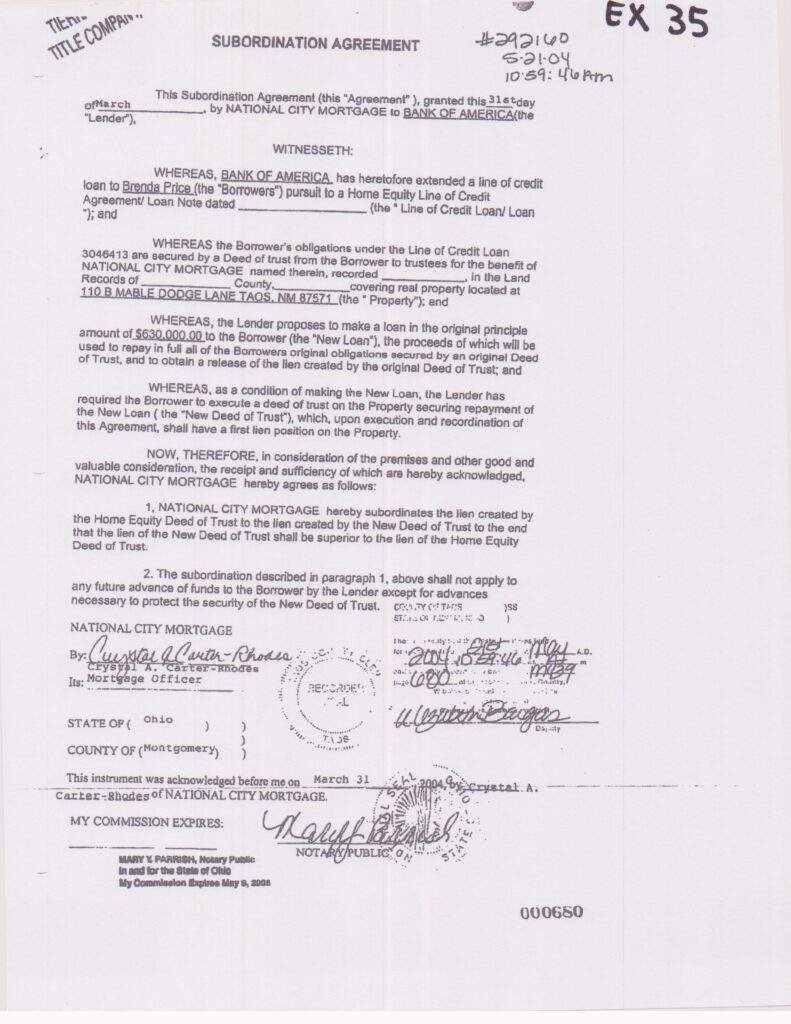

THE CURRENT CONTESTED MORTGAGE ON 110A MABEL DODGE LANE, TAOS, NM 87571 CARRIES WITH IT A $45K SECOND MORTGAGE ACCORDING TO THE HUD, FROM WHICH I RECEIVED $ZERO. ACCORDING TO CLOSER’S INSTRUCTIONS THIS $45K SECOND WAS CONVERTED TO A HELOC WHICH WAS THEN COVERTLY CONVERTED TO A 1ST-LIEN HELOC AND FRAUDULENTLY CONCEALED BY ORDERS OF BANK OF NEW YORK WHO WAS NOT A KNOWN PARTY OF INTEREST AT THE TIME, OCTOBER 14, 2003, XXXXXX2677, DISCOVERED SEPTEMBER 9, 2024; BANK OF NEW YORK COVERTLY FUNDED THE HELOC AND DEMANDED RETURN OF FUNDS UPON FAILURE TO CLOSE, ACCORDING TO CLOSER’S INSTRUCTIONS. ONLY THE HUD WITH COUNTRYWIDE SHOWING $45K SECOND MORTGAGE WAS MADE AVAILABLE TO ME AT THE CLOSING WITH COUNTRYWIDE AS THE LENDER. THIS $45k SECOND MORTGAGE WAS CALLED INTO DEFAULT AND WAS REPRESENTED UNDER COUNTRYWIDE AMERICA’S WHOLESALE LENDER IN FEDERAL CHAPTER 11 COURT, 11-05-10321. UPON CONFIRMATION OF THE PLAN, PARTIES ARE RETURNED TO THEIR STATUS PRIOR TO THE PLACEMENT OF THE STAY, SETTING THE TRIGGER FOR THE STATUTE OF LIMITATIONS DATE AS JANUARY 19, 2005+6=JANUARY 19, 2011, SOL; HOWEVER, THE FINAL DECREE AND ORDER GRANTING US TRUSTEE’S MOTION TO CONVERT TO CHAPTER 7 OR DISMISS THE CASE SETS THE STATUTE OF LIMITATIONS AT JANUARY 7, 2010 .

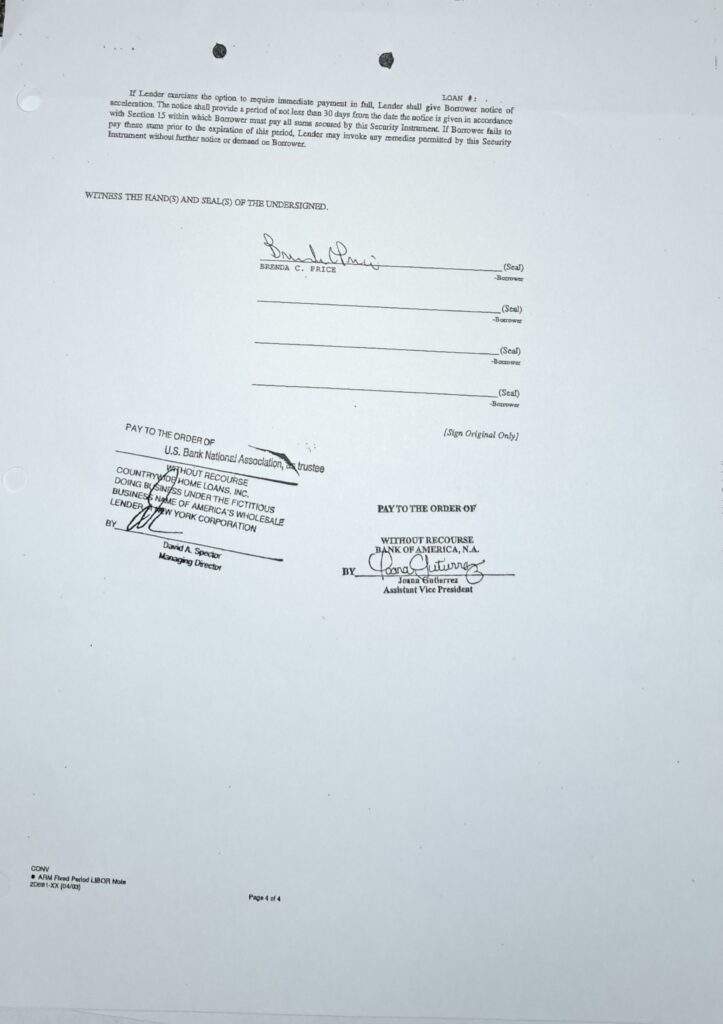

SIGNATORY PAGE FROM 2013 110A NOTE FROM ABOVE HUD. SECOND MORTGAGE WAS WITH COUNTRYWIDE ACCORDING TO HUD; THE CLAIM OF BANK OF NEW YORK MELLON IS BASED ON FRAUDULENT CONCEALMENT, AND SOL HAS EXPIRED JANUARY 11, 2011.

THE NOTE SIGNATURE PAGE SHOWS THE BANK OF AMERICA STAMP BECAUSE BANK OF AMERICA PURCHASED COUNTRYWIDE IN JULY OF 2008.

ALTERED NOTE PRESENTED TO DISTRICT COURT IN 2022 BY PLAINTIFF, COMMITTING FRAUD ON THE COURT. US BANK RECEIVED ASSIGNMENT IN SEPTEMBER 6, 2013, FROM BANK OF AMERICA, US BANK DID NOT RECEIVE THE INDORSEMENT IN 2003 FROM COUNTRYWIDE AS PLAINTIFF WOULD HAVE THE COURT BELIEVE, AND PLAINTIFF LIED TO THE JUDGE COMMITTING FRAUD ON THE COURT; NO RECORDS INDICATE SUCH, AND COUNTRYWIDE DID NOT EXIST IN 2013 WHEN US BANK RECEIVED THE ASSIGNMENT FROM BANK OF AMERICA ON 110A MABEL DODGE LANE, TAOS, NM 87571. UNDISCLOSED, BANK OF NEW YORK HAD PLACED A 1ST-LIEN HELOC ON THE COUNTRYWIDE SECOND MORTGAGE, OCTOBER 14, 2003 WHICH WAS USED TO OBTAIN A WRIT OF ASSISTANCE FROM JUDGE SHANNON TO CARRYOUT WRONGFUL EVICTION ON MAY 1, 2023, 20 YEARS LATER, VIOLATING THE FINAL DECREE ORDER 11-05-10321.

THESE DOCUMENTS ARE FROM THE CLOSER’S INSTRUCTIONS WHICH WERE NOT AVAILABLE TO ME, LATER PROVIDED BY VERA YUMA, CLOSER.

A CHECK IS WRITTEN IN THE AMOUNT OF $45,562- BROKER DUE $562, DEDUCTION: BROKER RECEIVED THIS CHECK, AND BANK OF NEW YORK MELLON, THE FUNDER, INSTRUCTED THE CLOSER TO REFUND BACK TO THEM THE AMOUNT OF $45K SHOULD THE CLOSING FAIL, OF WHICH I RECEIVED ZERO.

![]()

I WAS LIED TO BY THE BROKER THAT THIS LINE OF CREDIT WOULD BE AVAILABLE TO ME, BUT I RECEIVED ZERO FROM THIS LINE OF CREDIT AFTER SIGNING AN INITIAL DRAW STATEMENT; THE CHECK-MARK IS NOT MY LEFT-HANDED BACKWARD MARK. APPARENTLY THE BROKER RECEIVED THE FUNDS IN A CHECK MADE OUT IN THE AMOUNT OF $45,562, THEN THE HELOC WENT TO MERRILL LYNCH IN JUNE 16, 2023, ONE MONTH AND 15 DAYS AFTER WRONGFUL EVICTION BY BANK OF NEW YORK, MAY 1, 2023. PREDATORY LENDING IS STILL ALIVE AND FLOURISHING!

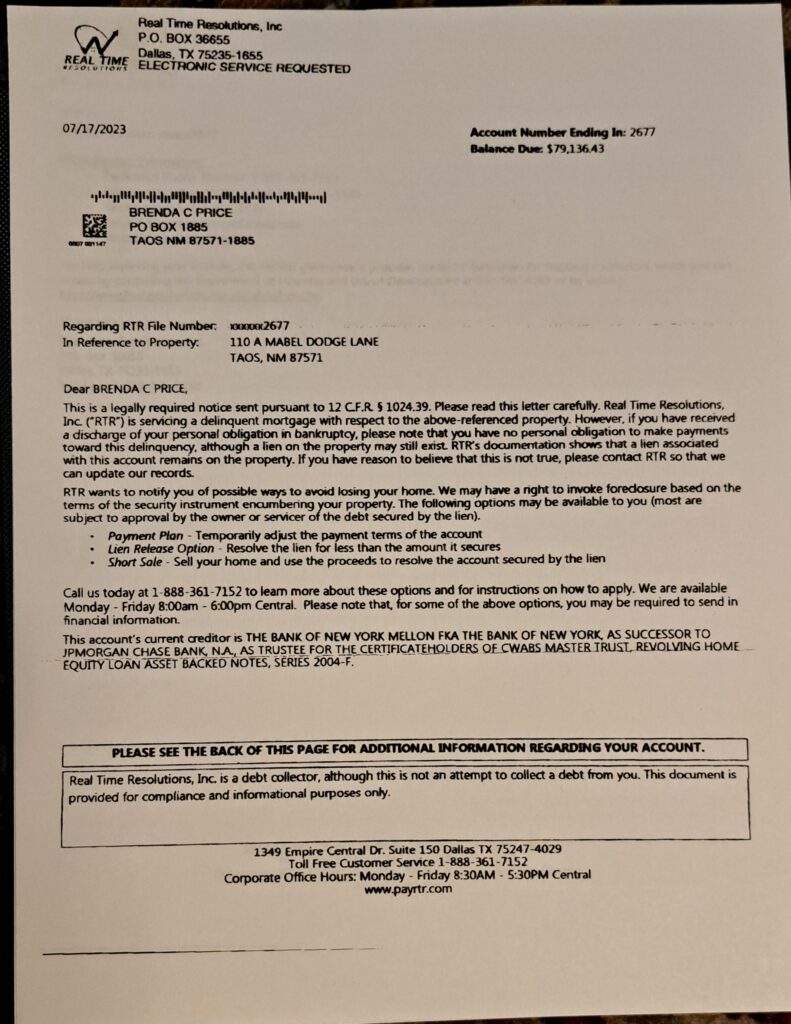

I RECEIVED FROM ROSE RAMIREZ, WHO REPRESENTS BANK OF NEW YORK MELLON ON 110B, A RESOLUTION TRUST NOTICE ON $45K HELOC ON 110A NAMING BONY MELLON JULY 17, 2023 THEN TRANSFERRED TO MERRILL LYNCH JUNE 15, 2023. IN NOTICE DATED OCTOBER 24, 2023. THIS 1ST-LIEN HELOC WAS FRAUDULENTLY CONCEALED AND I RECEIVED ZERO FROM THIS LINE OF CREDIT.

![]() 07-17-2023 RESOLUTION TRUST TO BANK OF NEW YORK MELON

07-17-2023 RESOLUTION TRUST TO BANK OF NEW YORK MELON

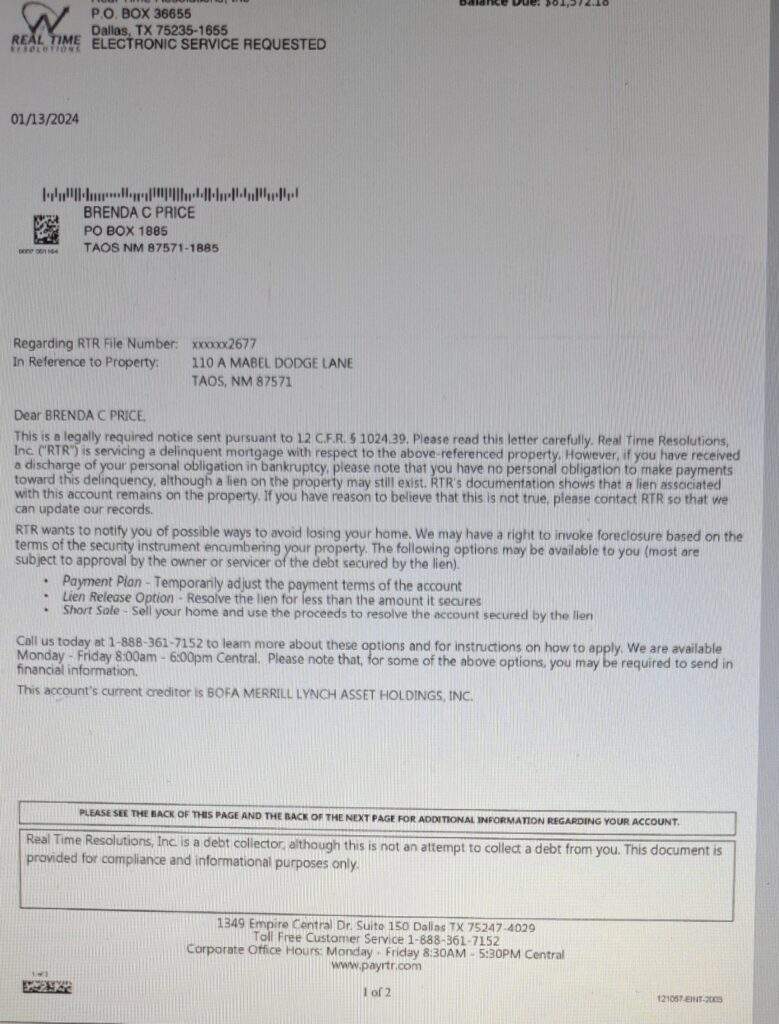

110A RESOLUTION TRUST MERRILL LYNCH 01-13-2024. […SUCCESSOR TO JP MORGAN BANK, NA AS TRUSTEE….DOES NOT MAKE SENSE. JP MORGAN CHASE WAS ALLEGEDLY ASSIGNED 110B MORTGAGE FROM BANK OF AMERICA, JANUARY 4, 2005, FILED FOR FORECLOSURE JANUARY 12, 2005, I FILED CHAPTER 11, JANUARY 19, 2005, JP MORGAN CHASE FILED ASSIGNMENT OF MORTGAGE ON JANUARY 21, 2005, AND SERVED ME THE SAME DAY IN VIOLATION OF CHAPTER 11 CODE. I NEVER RECEIVED AN ASSIGNMENT OF MORTGAGE AND PAID THE WRONG LENDER OVER $35,000.

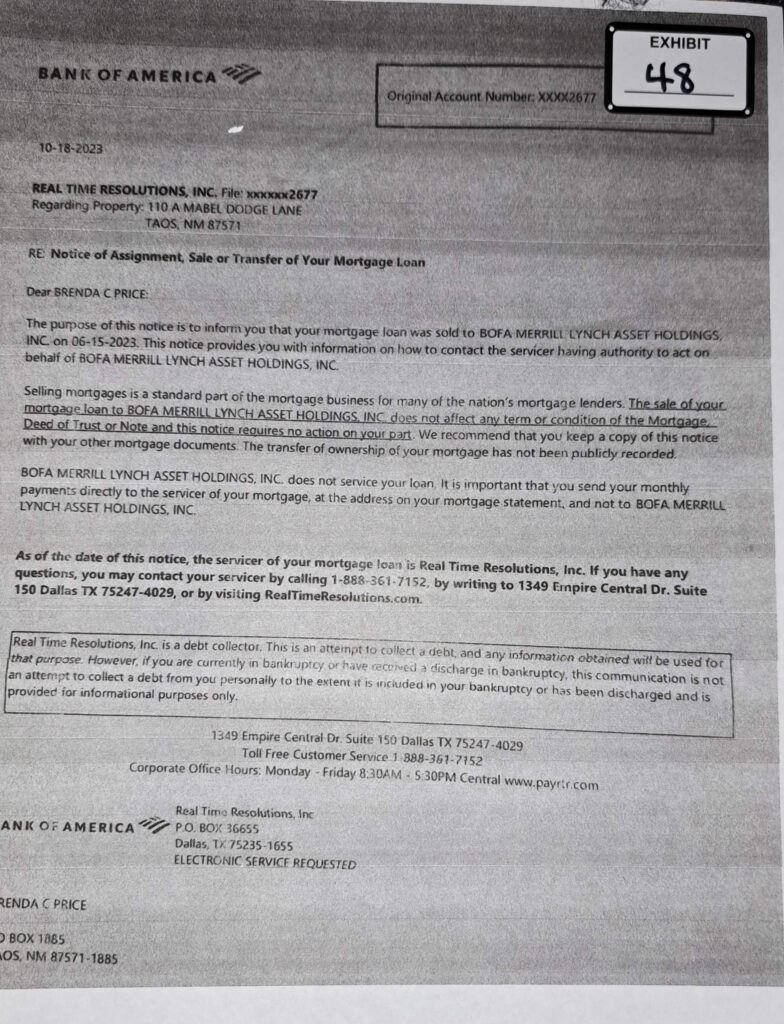

BANK OF AMERICA NOTICE TO ME, OCTOBER 18, 2023, OF XXXXXX2766 FROM BANK OF NEW YORK TO MERRILL LYNCH 6-15-2023, ONE MONTH AND 15 DAYS AFTER WRONGFUL EVICTION. I was denied benefit to me and received zero from this HELOC AND MADE PAYMENTS ON THIS SECOND MORTGAGE THROUGH AUGUST 2004.

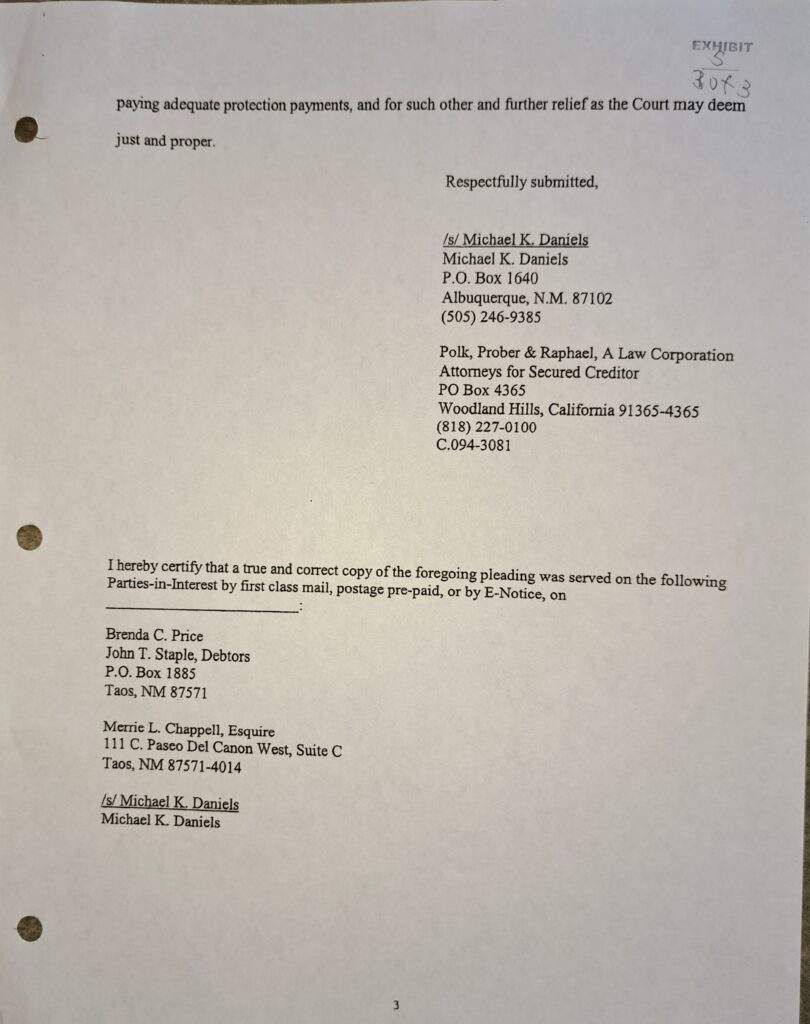

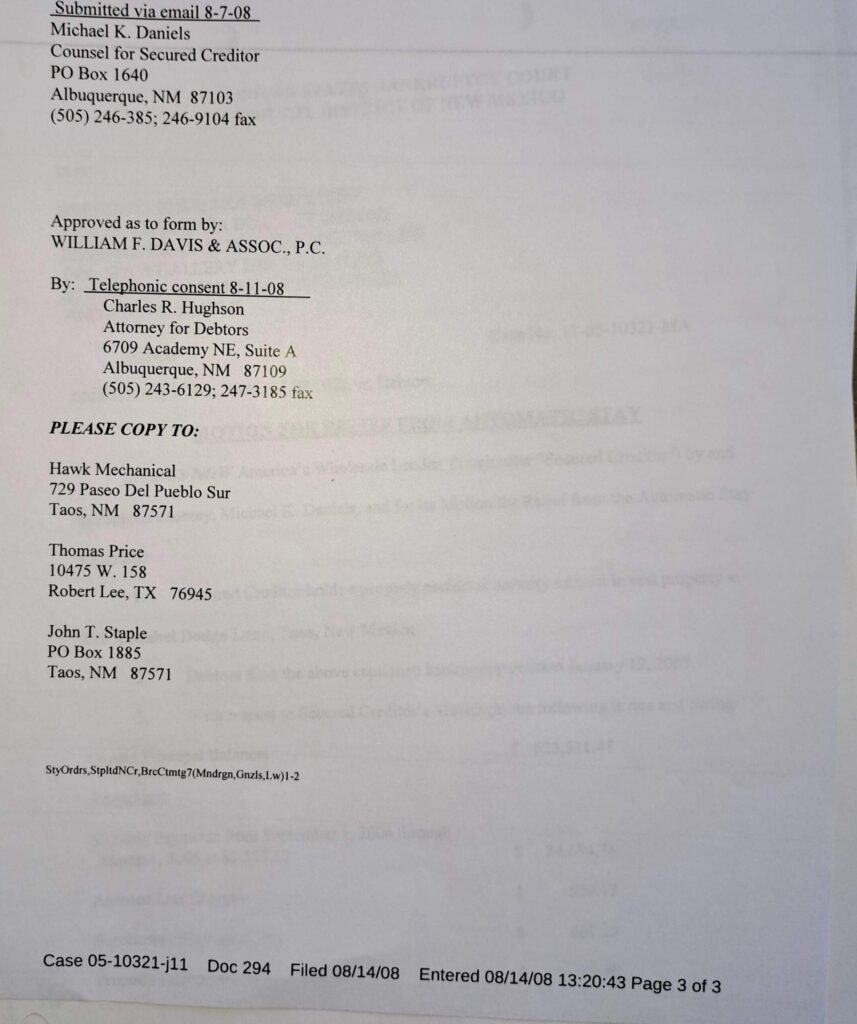

$45k COUNTRYWIDE SECOND MORTGAGE XXXXXX2766 REPRESENTED BY MICHAEL DANIELS IN FEDERAL CHAPTER 11 COURT 11-0510321. THIS IS THE SAME COUNTRYWIDE SECOND MORTGAGE COVERTLY CONVERTED BY BANK OF NEW YORK TO A 1ST-LIEN HELOC OCTOBER 14, 2003, AND FRAUDULENTLY CONCEALED WHICH LED TO WRONGFUL EVICTION 20 YEARS LATER, MAY 1. 2023.

FEDERAL STIPULATED ORDER SETS STATUTE OF LIMITATIONS TRIGGER AT JANUARY 19, 2005, SIX YEARS HENCE IS JANUARY 19, 2011; PARTIES ARE REVERTED TO STATUS PRIOR TO PLACEMENT OF STAY WHICH WAS January 19, 2005. US BANK RECEIVED ASSIGNMENT OF MORTGAGE: 9-06-2013 ASSIGNMENT OF MORTGAGE, BANK OF AMERICA TO MERS [US Bank Endorsement appears on the wrong stamp; it should be on the Bank of America stamp, BANK OF AMERICA PURCHASED COUNTRYWIDE, AMERICA’S WHOLESALE LENDER IN JULY OF 2008 AFTER AGREEING IN JANUARY TO DO SO. 110A PLAINTIFFS LIED TO THE JUDGE IN DISTRICT COURT THAT US BANK RECEIVED THE ASSIGNMENT FROM COUNTRYWIDE IN 2003. BUT THE DOCUMENTS US BANK FILED TO THE COURT WITH THEIR COMPLAINT WAS AN ASSIGNMENT FROM BANK OF AMERICA; THEY DID NOT FILE THE NOTE UNTIL EIGHT DAYS LATER WITH THE SIGNATURES ON THE NOTE BANK STAMPS OUT OF SEQUENCE.

11-25-2013 COMPLAINT FOR FORECLOSURE, US BANK [America’s Wholesale Lender becomes a Defendant – Foreclosure Complaint does not have the above NOTE attached, it is filed 8 days later]

6-29-2017 APPEAL FROM THE DISTRICT COURT OF TAOS COUNTY, ruled in favor of Defendant, US BANK HAS NO STANDING TO FORECLOSE.

BANK OF NEW YORK MELLON’S CLAIM FROM 2003 IS BASED ON FRAUDULENT CONCEALMENT, AND ALTERED NOTE SIGNATURE PAGE BY US BANK ON FIRST MORTGAGE.

FINAL DECREE – READ THE FOOTNOTES

READ THE FOOTNOTES

Pursuant to 11 U.S.C. Sec.350(a)2 and in accordance with Fed.R.Bankr.P,3022, “[a]fter an estate is fully administered in a chapter 11 reorganization case, the court, on its own motion or on motion of a party in interest, shall enter a final decree closing the case.” Rule 3022, Fed.R.Bankr.P. The court has previously determined that the debtor’s plan was fully consummated. See in re K.D.Co., Inc., 254 B.R.480,490(10th Cir. BAP 2000)(noting that “[a] confirmation order is a final judgment in the case, and neither it nor the plan that confirms may be attacked other than by filing a timely appeal.”)(citations omitted). Pursuant to Fed.R.Bankr.P 8002, a notice of appeal must be filed within ten days (now 14 days as of December 1, 2009) of the date of the order appealed from. PLAINTIFFS FAILED TO APPEAR AT THE LAST HEARING, AND PLAINTIFFS FAILED TO APPEAL IN A TIMELY MANNER; THEREFORE THIS DOCUMENT TAKES PRECEDENT OVER THE STIPULATED ORDER FOR STATUTE OF LIMITATIONS.

THIS IS THE DOCUMENT WHICH JP MORGAN CHASE SITES IN THEIR COMPLAINT FOR FORECLOSURE AS PROOF OF OWNERSHIP ON 110B MABEL DODGE LANE MORTGAGE; THIS DOCUMENT DOES NOT GIVE THEM STANDING TO FORECLOSE.