14 FLIPPED MORTGAGES

Over the course of this case, evidence and case exhibits show that the Plaintiffs committed fraud, conspiracy to commit fraud, extortion, coercion, embezzlement, two counts of fraudulent concealment, fraud on the court, violations of RESPA, TILA, HOEPA, HLPA, FDCPA, theft over $15,000 in the loan process, kickbacks, OCC violations resulting in high cost loans, Conflict of interest, alteration of Note Indorsements by Plaintiffs, failure of specific performance, Rico charges with wire fraud, grand larceny, collusion, cyber crimes, and voyeurism by drone.

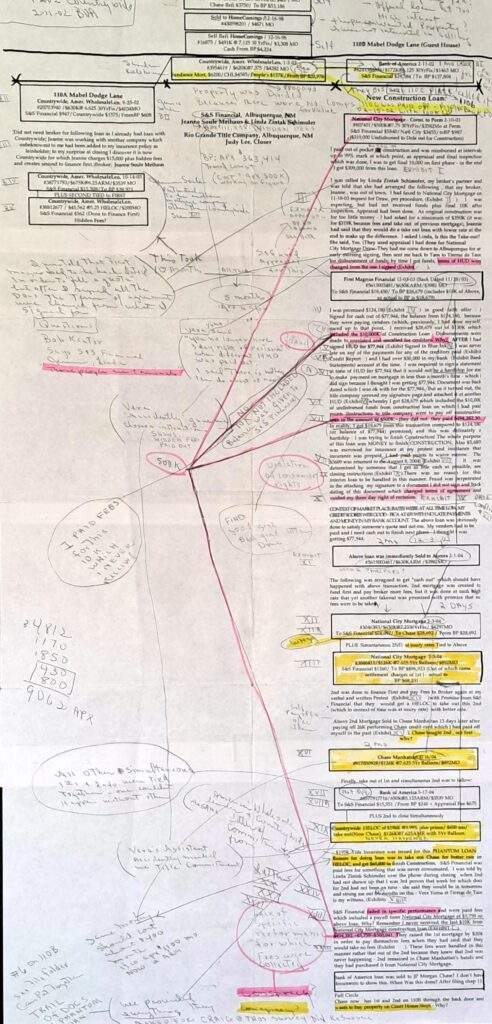

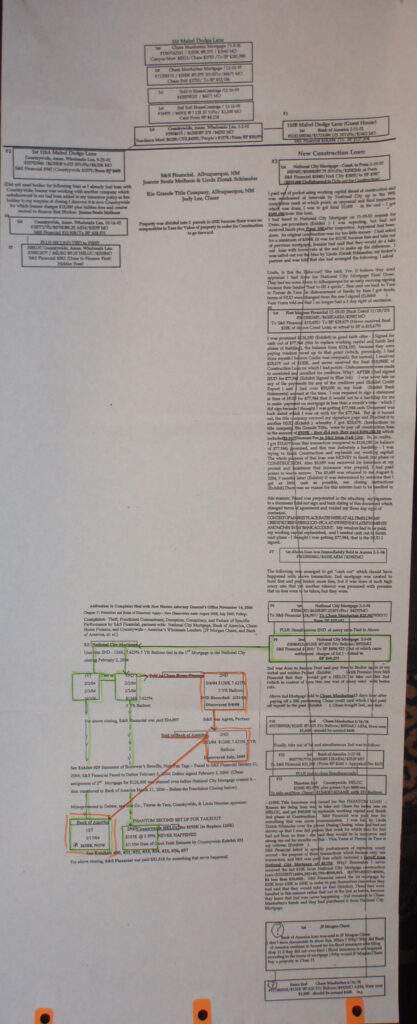

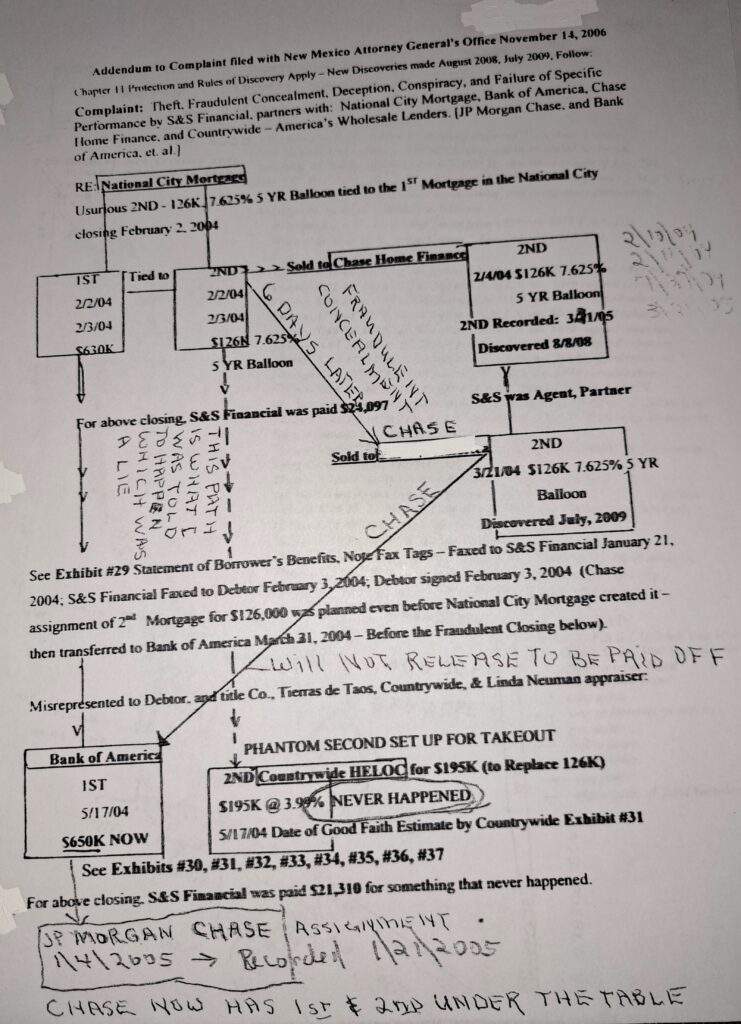

So many lies and concealments were promoted in the above mortgages it has taken years to discover the truth [new fraudulent concealment on 110A just discovered, June 9, 2024]. Above 110B corrected side bar clarification below shows the fraudulent concealment of the $126K Second Mortgage at high rates with a five year balloon, was sold to Chase 6 days after the original closing by S&S Financial under the guise of National City Mortgage, and all the while telling me that the egregious second mortgage would be paid off in the closing with the Bank of America purchase of the First Mortgage, while they had sold it them selves to Chase 6 days after the previous closing and knew it would be withheld from the promised closing. The Title Company even went so far as to arrange for title commitment in the amount of $195K which would garner to me $69,000 in order to finish construction. The Closers, the Title Company, and I were all deceived by S&S Financial who had set up all along conspiring with Chase to take over the property, causing me to fail, as seen in the bottom exhibit of Statement of Borrower’s Benefits, notice the FAX titles and dates at the top of the page committing wire fraud over and over.

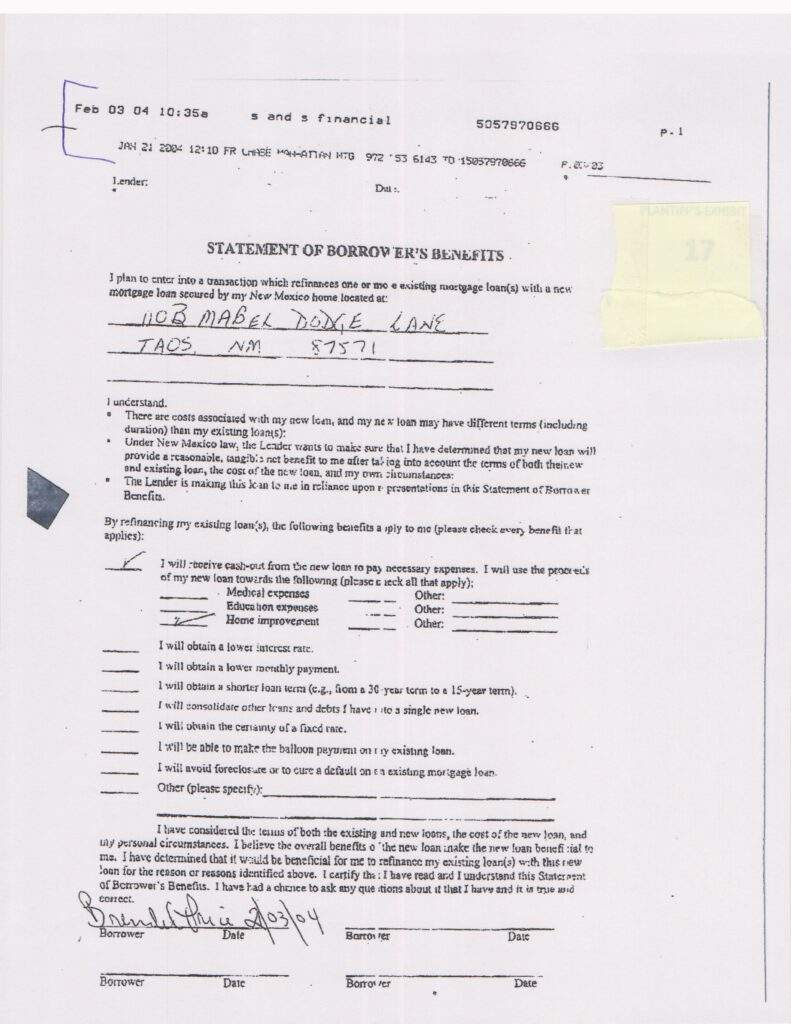

Note FAX SIGNATURES AT TOP OF PAGE, discovered September 2015 – the smoking gun. I was called on my cell phone while shopping January 23, 2004, at Office Depot in Santa Fe where this blank document was faxed with a cover sheet for me to sign and date February 3, 2004, “so the process can go forward,” and I was instructed to fax back the document to S&S Financial. Their agents filled in the check marks which are backward from mine; I am left handed.

Timeline of Conspiracy [The Exhibits numbered here are filed of record at District eight Court case March 30, 2016, case D-820-CV-2016-00094]

- January 21, 2004, Chase Manhattan Mortgage, who is not a legal party of interest, faxes to S&S financial a blank Statement of Borrower’s Benefits. See FAX tag on Exhibit ‘17’.

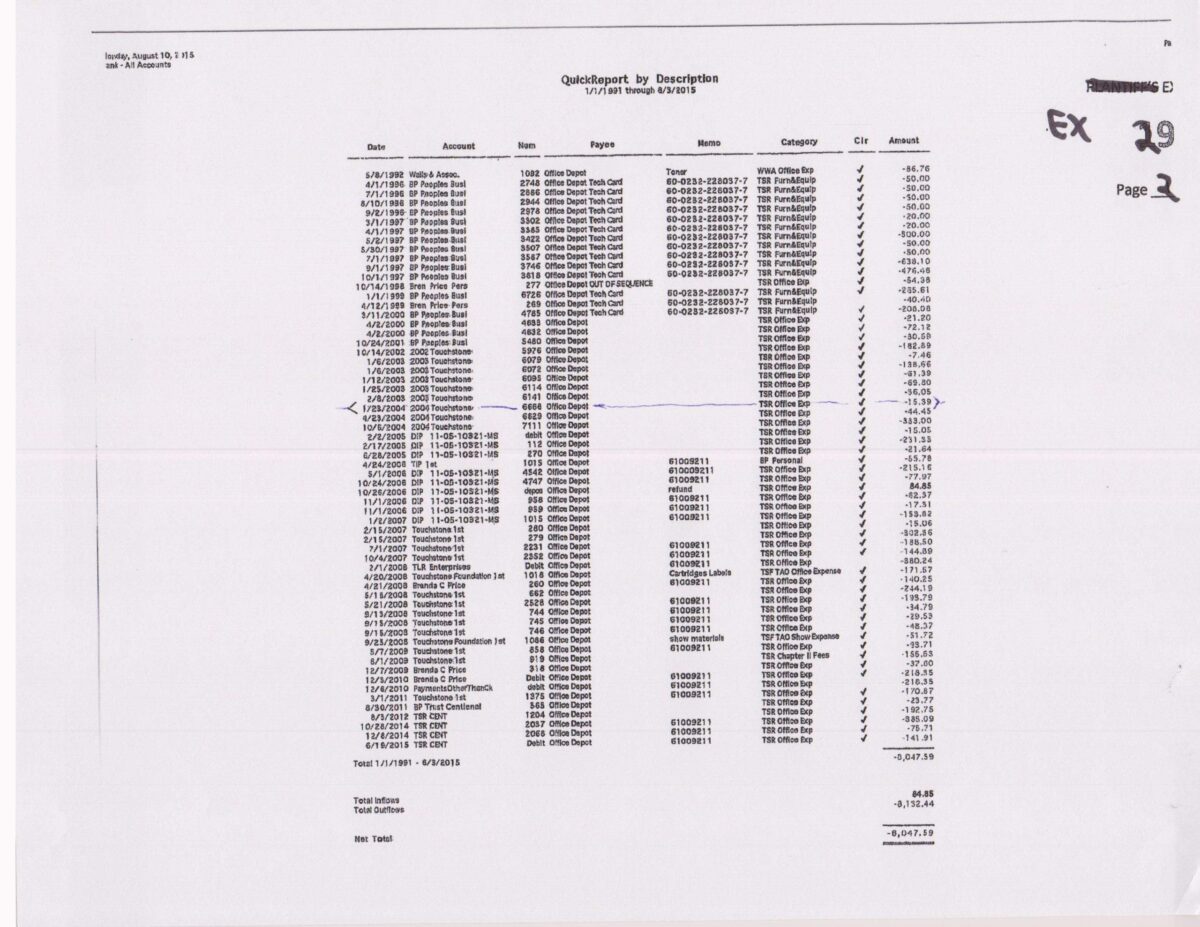

- January 23, 2004, the same Statement of Borrower’s Benefits is faxed to Me at Office Depot in Santa Fe to sign and I was instructed to date the document as February 3, 2004 and fax it back to S&S Financial. See Exhibit ‘29’ below (filed OF RECORD as exhibit 19 and 17).

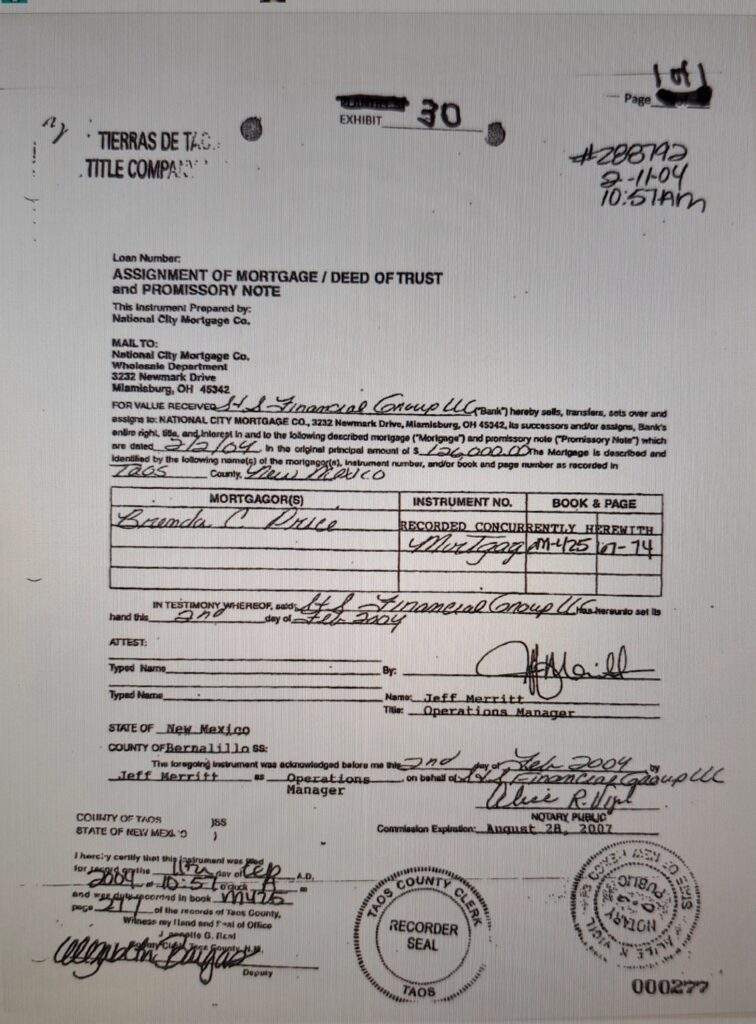

- February 2, 2004, S&S Financial loans to National City Mortgage the amount of $126,000. See Exhibit ‘20’ of case D-820-2016-00094 filed of record.

- February 3, 2004 , Closing occurs in Taos between National City Mortgage and Me for a high interest First Mortgage in the amount of $630,000 and a high interest Second Mortgage in the amount of $126,000 with a Five-Year Balloon; the terms of both mortgages are unconscionable. Unknown to Me, S&S Financial is the actual Lender under the guise of National City Mortgage, as well as the Broker, a conflict of interest. The same Statement of Borrower’s Benefits is faxed by S&S Financial to the closer for inclusion in both documents – the check marks on the Statement of Borrower’s Benefits are not mine, nor is the information in my handwriting; I am left-handed. Unknown to me at this Closing, and not authorized by me, Chase who is not a party of interest is favored with a check from the funds for $25,000; I get $68,000 while I am expecting in the neighborhood of $96,000. See Exhibits ‘21’, ‘22’, ‘23’ ‘24’, ‘25’

- February 9, 2004, Unknown to me, six days after the Closing referred to in #4, the high rate $126,000 Second Mortgage with Five-Year Balloon is purchased from S&S Financial by Chase and is fraudulently concealed from me; this Second Mortgage is held in abeyance from the next closing on May 17, 2004 where it is supposed to be paid off. See Exhibits ‘26’, ‘27’, ‘35’

- March 31, 2004, Unknown to me, 50 days after Closing referred to in #4, the $630,000 First Mortgage is subordinated from S&S Financial under the guise of National City Mortgage to Bank of America as a Home Equity Line of Credit; this is the document, 680 that JP Morgan Chase later uses to cite ownership of the note on which they are foreclosing, January 12, 2004; they do not have Standing to foreclose. See Exhibit ‘28’

In May of 2004, I am in the middle of Construction of my Residential Teaching Studio – the second phase of construction representing the whole front of the building is just poured footings at this point.

I am promised from the very beginning before the $500,000 Construction Loan is taken out in February of 2003, that I will get $130,000 more in cash to finish construction in the form of a Second Mortgage based on the value of property as is at this point. Apparently the rules were changed and more that $500,000 can be had on a First Mortgage in 2004, (in 2003, I was told the limit was $500k) but over and over I get a fraction of the $130,000 that is added to the principle; I get $18,000 cash for construction from the First Magus Loan that added $130,000 to the $500,000 Construction to Permanent Loan becoming a $630,000 First Mortgage done at the end of November of 2003 which should have been the end and construction finished. See Exhibits ‘8’, ‘9’, ‘10’, ‘11’’12’, ‘13’, ‘14’, ‘15’, and ‘16’

- May 17, 2004, Closing between Bank of America and Me – mortgage dated May 14, 2004 (which negates my 3-day right of rescission) is supposed to be a refinance of $630,000 by Bank of America at a lower rate and no closing costs, but closing adds $20,000 to principle which is paid to Broker, S&S Financial in spite of Lack of Specific Performance, there is no net benefit to me. See Exhibits ‘29’, ‘30’, ‘32’, ‘33’, ‘34’

- May 17, 2004, Countrywide, America’s Wholesale Lender (now Bank of America as of July 2008) is to close simultaneously with #7 in order to pay off the egregious $126,000 5-Year Balloon Second Mortgage with a $195,000 Home Equity Line of Credit whereby I am to receive $69,000 cash out to finish construction; I was lied to, does not happen. See Exhibit ‘31’

- May 17, 2004, Bank of America mortgage becomes $650,000 with no advance notice to me with $20,000 added to the Principle and the Broker is paid over $20,000 for something that never happens, re #8. This mortgage yields no net benefit to me, in fact I must pay for the appraisal and the survey ordered by S&S Financial. See Exhibits ‘29’, 30’, ‘32’

- May 17, 2004, When questioned over the phone during the Closing as to the whereabouts of the documents for the $195,000 Second mortgage, Ms. Zintak- Schmoller says, “You are the third person this week this has happened to; the documents are just delayed and will be there in a couple of days.” So I wait; another lie. The three day right of rescission is negated because the mortgage is back- dated to May 14, 2004 and is filed as such, May 21, 2004, along with the Assignment of Mortgage referred to in #6, page 680, two months after original closing. See Exhibit ‘29’

- The documents referred to in #10 never come; the whole front of the house is just footings at this point and is never finished with bank monies. I am left with a higher mortgage with no net benefit, plus the egregious $126,000 5-Year Balloon Second Mortgage is still in place, the building remains unfinished as far as the Bank is concerned, and I am responsible for property insurance payments to cover the egregious lien amounts. See Exhibits ‘50’, ‘51’, ‘52’, ‘53’

- September 14, 2004, (four months after the Closing May 17, 2004) I am instructed by my financial advisor to file Chapter 11, retaining an attorney, Merrie Chappell on October 1, 2004, who is supposed to file at the end of December, 3 months later as is Chapter 11 rule; as it turns out, my attorney tells Max Stroback, her client to file a contractors lien, and she tells her college roommate, Sharon Hankla that she is filing, and gives her enough time to file for foreclosure January 12, 2005, before Merrie Chappell files my Stay January 19, 2005. Hankla is not able to file the assignment of mortgage until January 21, 2005, because she does not possess it, and that date is the same as when I was served. Nothing in her document gives her client, JP Morgan Standing to foreclose.

- January 4, 2005, (last payment September 4, 2004), Unknown to me, Bank of America assigns to JP Morgan Chase the $650,000 First Mortgage which is paired with the $126,000 Second Mortgage with the Five-Year Balloon which Chase purchased prior to the first and fraudulently concealed it, referred to in #5. Chase accepts a mortgage which they know is in default as is stated in their Complaint for Foreclosure document; therefore Chase is not a ‘Holder in Due Course’, and now Chase owns both mortgages without having gone to Closing with me, and because I never get an assignment of mortgage, I pay the wrong Lender over $38,000. See Exhibits ‘54’, ‘60’

- January 19, 2005, my attorney, Merrie Chappell files Chapter 11, which should have been filed December31, 2004. The last mortgage payment to Bank of America is made on August 4, 2004 – one cannot favor one creditor over another 90 days prior to filing of Chapter 11. See Exhibit ‘39’

- January 21, 2005, JP Morgan Chase accepts Assignment of Mortgage they know is in default and fails to notify me of the Assignment of Mortgage. See last page of Exhibit ‘37’

- January 21, 2005, same date as #15, JP Morgan Chase Serves to me the Summons and Complaint for Foreclosure, violating Chapter 11 Code; nothing in the Complaint refers to JP Morgan Chase as the owner. All documents cited relate to Bank of America specifically, pg 680, referred to in #6. See Exhibits ‘38’, ‘40’

- March 21, 2005, the name on the $126,000 Second Mortgage with 5-Year Balloon is corrected to read Chase Manhattan Mortgage, not Chase Home Finance. See Exhibit ‘49’

- April 1 through December 31, 2007, I pay Bank of America over $38,000 on a mortgage that is apparently owned by JP Morgan Chase. No payments were ever made to JP Morgan Chase; in fact, my last Chapter 11 attorney, Thomas Dunnigan asked across the table the attorneys for Chase before the start of hearing, Why are you here? They just laughed. See Exhibit ‘64’

- January 7, 2010, the Chapter 11 case is dismissed as fully consummated, read the footnotes. See Exhibits ‘58’, ‘67’ ‘70’

- April 12, 2010, through June 23, 2013, in good faith, I applied to the government Home Modification Loan program for Bank of America 18 times and met face to face with Bank of America representatives February 5, 2013, asking to modify to no more than I actually received and disputing the debt as fraud. I am told that even though I qualify, “there is forbearance on your property and there is nothing we can do.” See Exhibit ‘64’

- March 30, 2016, case D-820-CV-2016-00094, filed against JP Morgan Chase, et al / Fraud and Conspiracy to commit Fraud. In this cause of action, justice relies on Extant Circumstances yet to be brought before the court, which relate back to the original Counterclaim filed on August 25, 2015. The statute is tolled from the Federal Stipulated Order for secured creditors and the Order Granting US Trustee’s Motion to Dismiss Chapter 11 case #11-05-10321, January 7, 2010.

Sometimes, it is not reasonably possible for a person to discover the cause of injury in a timely manner especially when the elements of a cause are deliberately obfuscated to hide wrongdoing. Rule of law and the Uniform Commercial Code are set up to guide and protect Lenders as well as Borrowers, but when these rules are ignored, individuals as well as the public suffer. Count IV of a new counterclaim will endeavor to bring forth a Paper Trail Presentation in the course of which JP Morgan Chase becomes the owner of the First and Second Mortgages on 110B Mabel Dodge Lane, having neither gone through Closing with the Borrower, nor having served her with a Notice of Assignment resulting in incalculable damage, not the worst of which is payment of over $38,000 to the wrong Lender.

From the very beginning, before the $500,000 Construction-to-Permanent loan is taken out February 10, 2003, I am promised $130,000 additional cash to finish construction in the form of a second mortgage based on the future value of the property. (From the $500K, 319K is withheld for construction, but only $309K is disbursed as I pay out of pocket for construction ahead of disbursements). I am told that $500,000 is the limit for a first mortgage, apparently another lie; but in December of 2003, $130,000 is added to the first mortgage becoming $630,000 whereby I received a net of approximately $18,000 while being promised $124,000 cash out. At that point the construction should have been funded and there should have been no more mortgages, but S&S Financial used the funds toward their own agenda, backdating documents to fill a quota and setting up further mortgages ostensibly to get cash out for construction, but over and over falling short while I am in the middle of construction desperate for the cash promised, eventually shutting down the construction with a half finished building.

Over the course of time, from October 10, 2002 to May 17, of 2004, I am led through 14 mortgages, 7 in the span of 5 months in an effort to fund construction of a residential teaching studio at a projected cost of approximately $450,000. On 110-B, in total, I received $405,000 from all of the loans toward the construction at a cost of $455,000 with $191,000 of that being added to mortgage principle on 110B. The whole process is rife with misconduct, fraud and deception.

In the above timeline the Broker, S&S Financial, LLC, who is also the Lender for the original $630,000 loan on 110B Mabel Dodge Lane which became $650,000 paying the Broker for something that did not happen, is telling me one thing and doing something entirely different, complicit with Bank of America and JP Morgan Chase. See Exhibits ‘8’, ‘9’, ‘45’

THIS FOLLOW THE MONEY CHART HAS BEEN AN EPIC JOURNEY OF DISCOVERY TO FIND OUT WHAT HAPPENED TO MY LAST $10,000 FROM THE CONSTRUCTION LOAN WHICH I NEVER RECEIVED. ULTIMATELY I WAS LED TO TWO KICKBACKS TO THE BROKER, SEE PINK LINE, $5,000 AT BEGINNING AND $5,000 AT END.